© 2021 AICPA. All rights reserved.

A U GUS T 2 0 2 1

Employee Benefit Plans Industry FAQ with

Illustrative Auditor’s Reports for Initial Year

of Implementation of SAS No. 136, as

Amended

The following frequently asked question (FAQ) and illustrative auditor’s reports have been developed to

aid practitioners as they apply AICPA Statement on Auditing Standards (SAS) No. 136, Forming an

Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA, as amended,

in their audits of financial statements of employee benefit plans subject to the Employee Retirement

Income Security Act of 1974 (ERISA) in the initial year of implementation.

This document was prepared by AICPA staff to provide nonauthoritative guidance on applying SAS No.

136, as amended in the initial year of implementation. These illustrative auditor’s reports represent the

views of AICPA staff based on the input of members of the AICPA Employee Benefit Plans Expert Panel;

they have not been approved, disapproved or otherwise acted upon by a senior committee of the

AICPA.

Auditor’s Reports for Initial Year of Implementation of SAS No. 136, as Amended

Question — What Will the Auditor’s Report Look Like When Implementing the EBP SAS in the

First Year?

Statement on Auditing Standards (SAS) No. 136, Forming an Opinion and Reporting on Financial

Statements of Employee Benefit Plans Subject to ERISA, as amended (hereinafter referred to as the EBP

SAS in this document), prescribes certain new performance requirements for an audit of financial

statements of employee benefit plans subject to the Employee Retirement Income Security Act of 1974

(ERISA) and changes the form and content of the related auditor’s report. It should not be adapted for

plans that are not subject to ERISA. The EBP SAS has been codified in AU-C section 703, Forming an

Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA,

1

and is

effective for audits of financial statements for periods ending on or after December 15, 2021, with early

1

All AU-C sections can be found in AICPA Professional Standards.

© 2021 AICPA. All rights reserved.

implementation permitted. Because ERISA requires that certain comparative financial statements be

presented, what will the auditor’s report look like when implementing the EBP SAS in the first year?

Reply

Exhibit B of the EBP SAS addresses what the auditor’s report could look like in the initial year of

implementation of the EBP SAS for a continuing auditor when the auditor performed a limited-scope

audit (disclaimer of opinion) in the prior year and an ERISA Section 103(a)(3)(C) audit in the current year.

Exhibit B of the EBP SAS illustrates when the auditor issues two separate reports in the year of

implementation. The current year is an ERISA Section 103(a)(3)(C) report and the prior year is a

disclaimer of opinion, both of which have the same report date because the auditor updates the prior

year report (see paragraph .86 of AU-C section 703 for discussion about updating the report). When

illustration B-1 in exhibit B of the EBP SAS was developed, early implementation of the EBP SAS was not

permitted. Subsequently, SAS No. 141, Amendment to the Effective Dates of SAS Nos. 134−140, changed

the effective date and permitted early implementation.

Illustrations for Reporting in the Year of Implementation of the EBP SAS Under Various Scenarios

The following illustrations provide the auditor with options for reporting in the year of implementation

of the EBP SAS under various scenarios. Each illustration includes additional circumstances that are

unique to that illustration. The illustrations have been developed for informational purposes and have

no authoritative status; however, they may help the auditor understand and apply the EBP SAS. For all

illustrations, the following circumstances apply.

• The audit is for a complete set of general purpose financial statements for a 401(k) plan subject

to ERISA that is presenting comparative statements of net assets available for benefits and a

single-year statement of changes in net assets available for benefits.

• Management is responsible for the preparation of the financial statements in accordance with

accounting principles generally accepted in the United States of America, as promulgated by the

FASB.

• The terms of the audit engagement reflect the description of management's responsibility for

the financial statements in AU-C section 210, Terms of Engagement, and AU-C section 703.

• Except for illustration 1−5, there are no limitations on the scope of the audit for the current year,

and the auditor has not identified any material misstatements of the ERISA plan financial

statements.

• Based on the audit evidence obtained, the auditor has concluded that there are no conditions or

events, considered in the aggregate, that raise substantial doubt about the plan's ability to

continue as a going concern for a reasonable period of time in accordance with AU-C section

570, The Auditor's Consideration of an Entity's Ability to Continue as a Going Concern.

• The auditor has not been engaged to communicate key audit matters.

© 2021 AICPA. All rights reserved.

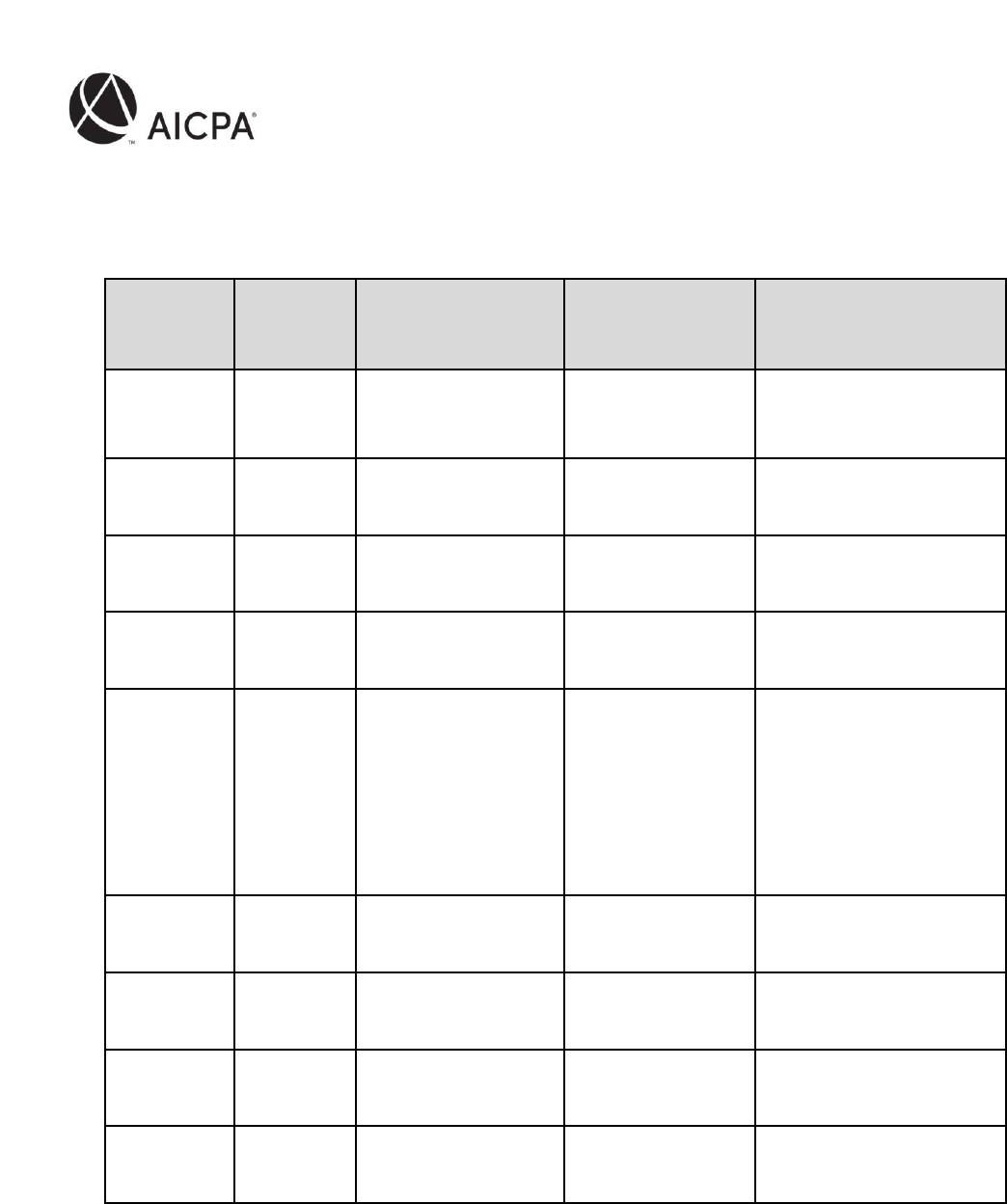

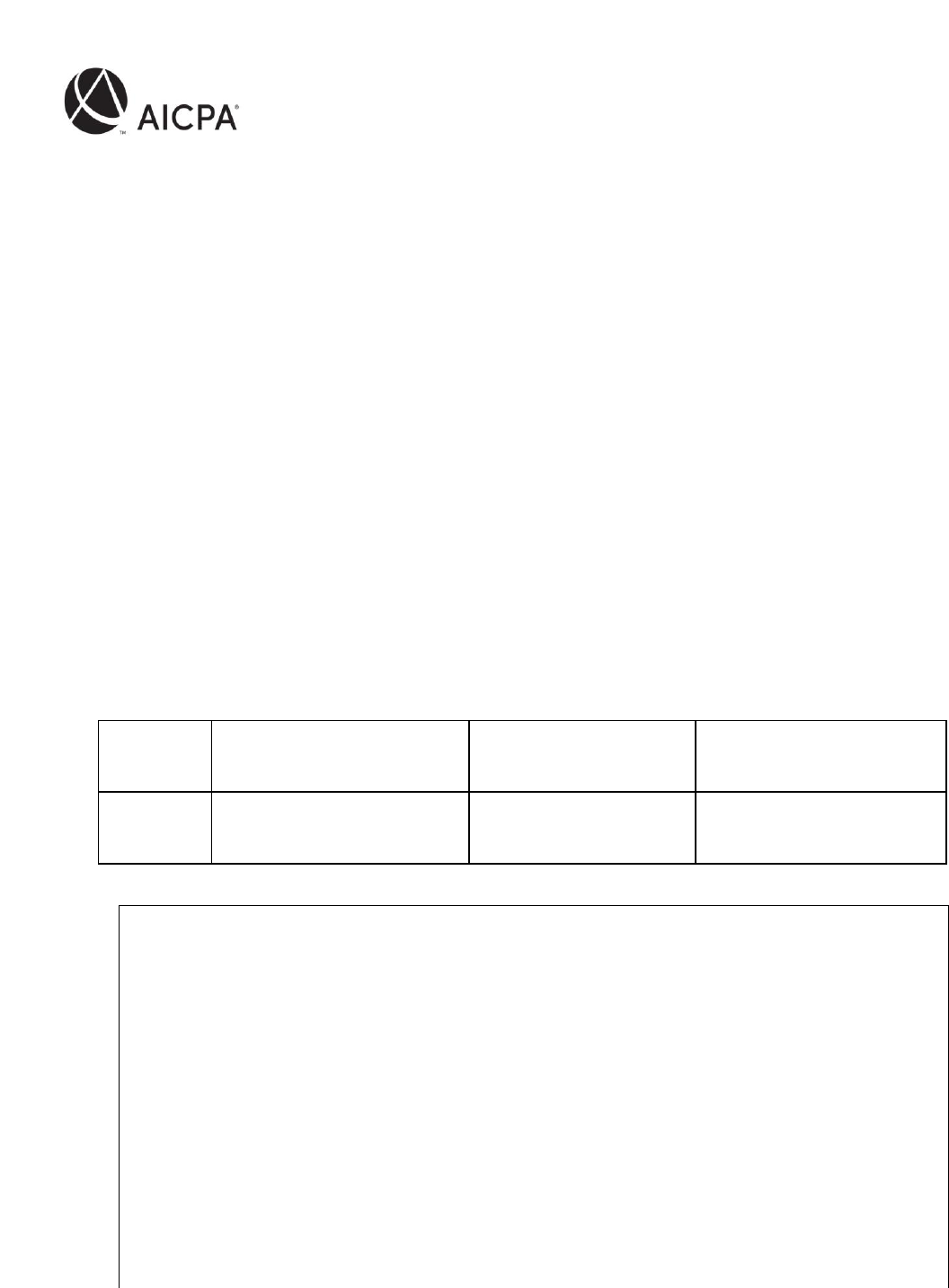

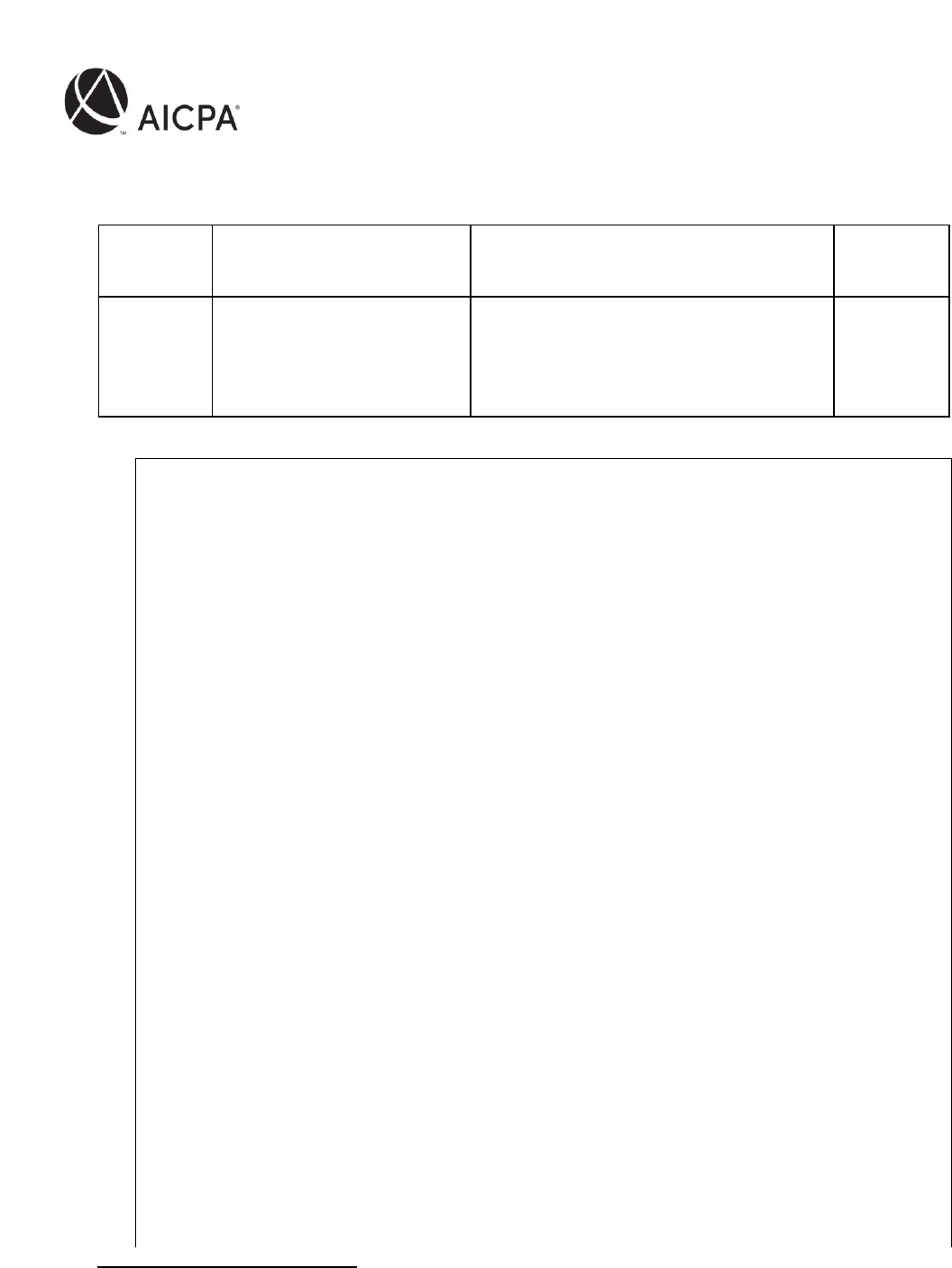

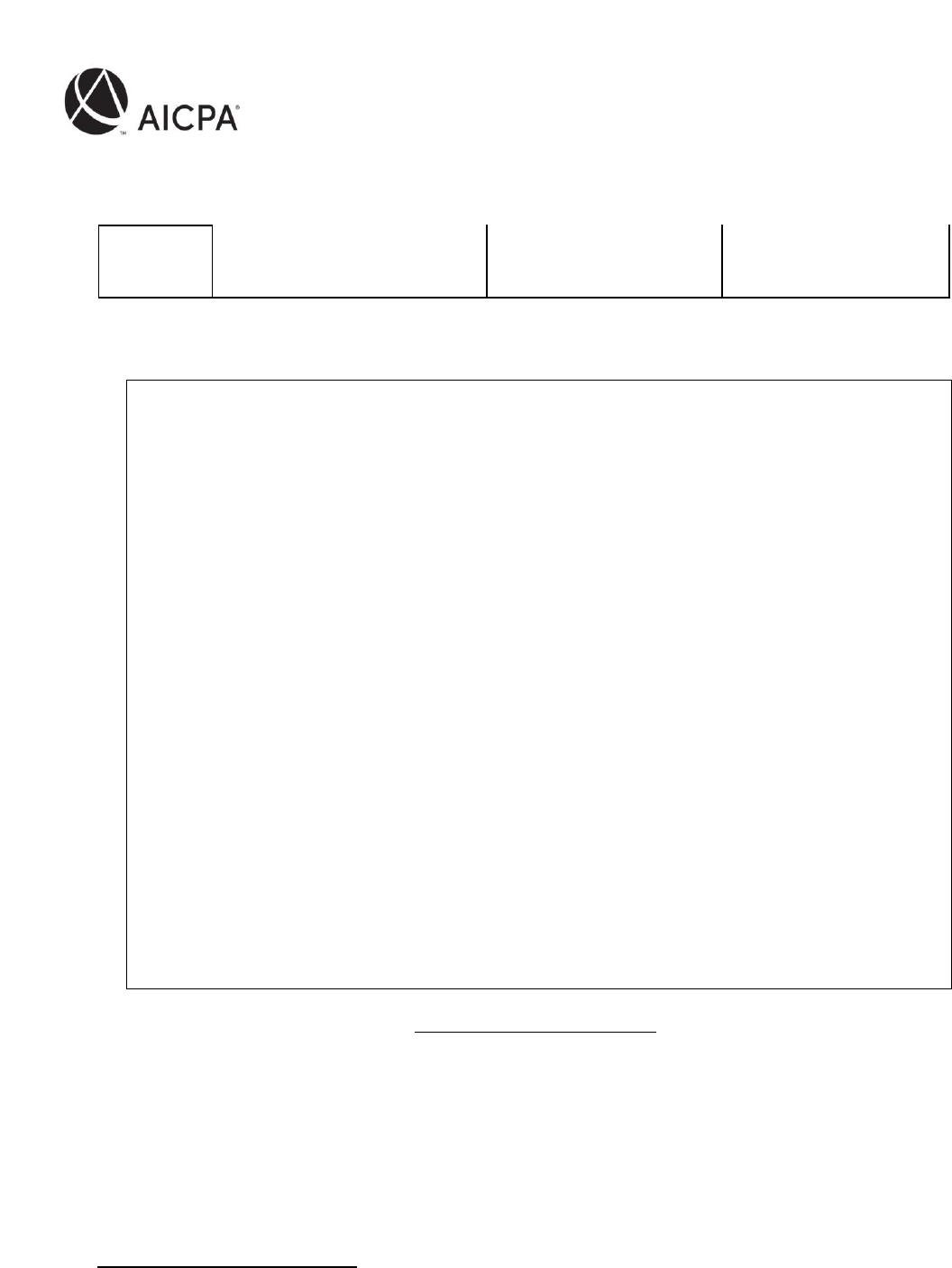

The following table summarizes the example reports illustrated.

Illustration

No.

Type of

plan

Current year (2021) –

type of audit

Prior year (2020) –

type of audit

Conditions

1-1

401(k)

ERISA Section

103(a)(3)(C)

Limited scope

Continuing auditor

1-2

401(k)

ERISA Section

103(a)(3)(C)

Full scope

Continuing auditor

1-3

401(k)

Non-Section

103(a)(3)(C)

Limited scope

Continuing auditor

1-4

401(k)

Non-Section

103(a)(3)(C)

Full scope

Continuing auditor

1-5

403(b)

ERISA Section

103(a)(3)(C) with a

limitation on the

scope of the audit

Limited scope with

respect to

investment

information and

additional

limitation on the

scope of the audit

Continuing auditor

1-6

401(k)

ERISA Section

103(a)(3)(C)

Limited scope

Prior period audited by

predecessor auditor

1-7

401(k)

ERISA Section

103(a)(3)(C)

Full scope

Prior period audited by

predecessor auditor

1-8

401(k)

Non-Section

103(a)(3)(C)

Limited scope

Prior period audited by

predecessor auditor

1-9

401(k)

Non-Section

103(a)(3)(C)

Full scope

Prior period audited by

predecessor auditor

© 2021 AICPA. All rights reserved.

Continuing Auditor Situations

Illustration 1-1

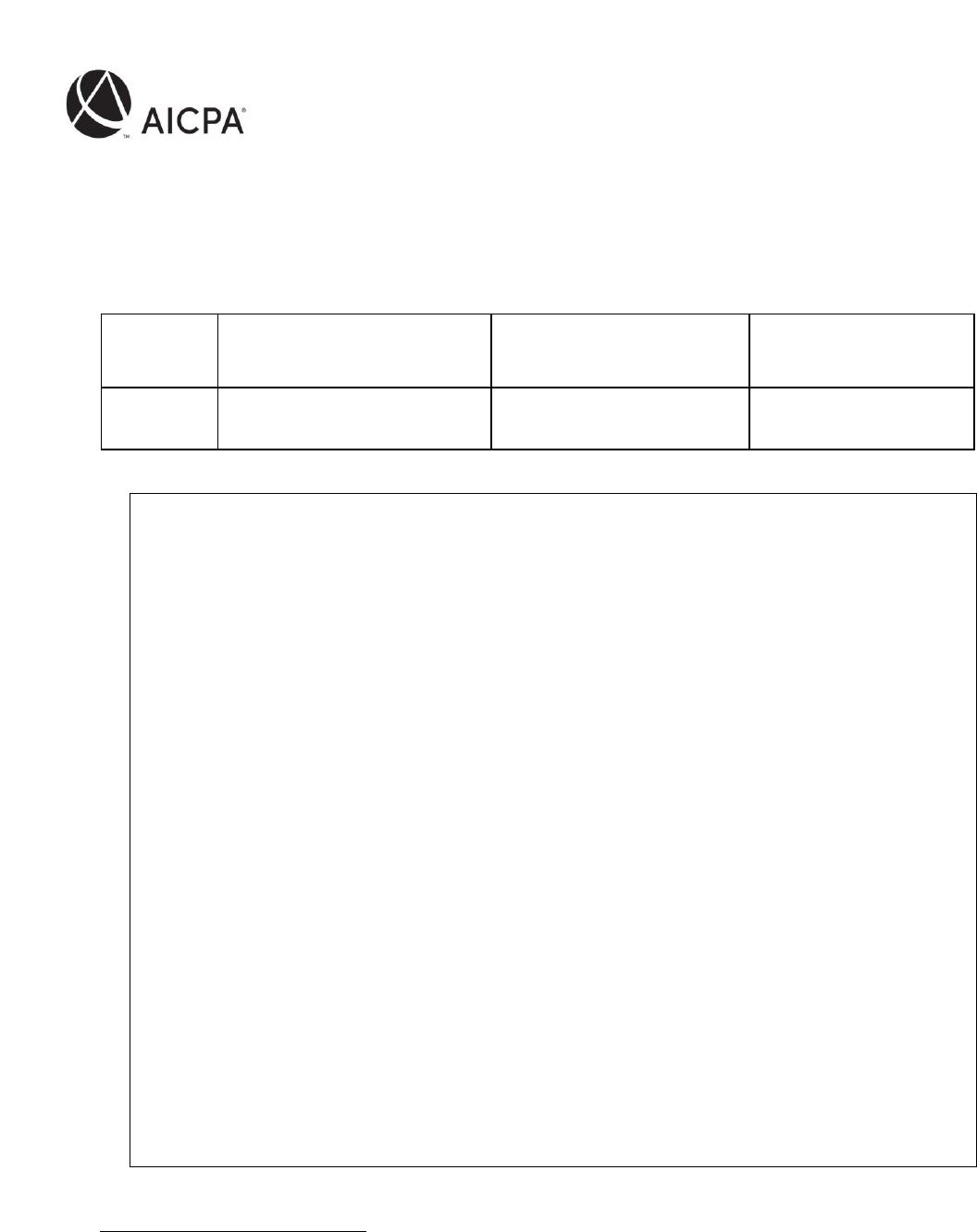

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type of

audit

Conditions

401(k)

ERISA Section 103(a)(3)(C)

Limited scope

(disclaimer of opinion)

Continuing auditor

Circumstances include the following:

• Management elected an ERISA Section 103(a)(3)(C) audit for the 2021 plan year financial

statements as permitted by Code of Federal Regulations (CFR), Labor, Title 29, Section 2520.103-8

of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

2

• The auditor performed an ERISA Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

• The auditor has concluded that the ERISA Section 103(a)(3)(C) report is appropriate as of and for

the year ended December 31, 2021 based on the audit evidence obtained.

• The auditor performed a limited-scope audit and disclaimed an opinion on the prior year financial

statements (for the year ended December 31, 2020).

• Rather than issue two reports as illustrated in exhibit B of AU-C section 703, the auditor is issuing

one report and referring to the prior year (2020) report in an other-matter paragraph in the

current year (2021) report. In such situations, the auditor typically requests plan management to

provide written representations for both years (see paragraph .A127 of AU-C section 703).

• The report on the 2021 ERISA-required supplemental schedules is presented as an other-matter

paragraph in accordance with paragraph .132 of AU-C section 703. The auditor has concluded

that the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment information, is

presented, in all material respects, in conformity with the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. The information in the supplemental

schedules related to assets held by and certified to by a qualified institution agreed to or is

derived from, in all material respects, the information prepared and certified by an institution that

management determined meets the requirements of ERISA Section 103(a)(3)(C).

2

Although not as common, an ERISA Section 103(a)(3)(C) audit may relate to the audit of a 103-12 entity as

permitted by Title 29, Labor, U.S. Code of Federal Regulations, Section 2520.103-12 of the Department of Labor's

Rules and Regulations for Reporting and Disclosure under ERISA. Accordingly, the wording in this illustrative report

may need to be revised to fit the circumstances of the engagement.

© 2021 AICPA. All rights reserved.

Independent Auditor's Report

[Appropriate Addressee]

Scope and Nature of the ERISA Section 103(a)(3)(C) Audit for the 2021 Financial Statements

3

We have performed an audit of the financial statements of ABC 401(k) Plan, an employee benefit

plan subject to the Employee Retirement Income Security Act of 1974 (ERISA), as permitted by ERISA

Section 103(a)(3)(C) (ERISA Section 103(a)(3)(C) audit). The financial statements comprise the

statement of net assets available for benefits as of December 31, 2021, and the related statement of

changes in net assets available for benefits for the year then ended, and the related notes to the

financial statements (2021 Financial Statements).

4

Management, having determined it is permissible in the circumstances, has elected to have the

audit of the 2021 financial statements performed in accordance with ERISA Section 103(a)(3)(C)

pursuant to 29 CFR 2520.103-8 of the Department of Labor's Rules and Regulations for Reporting

and Disclosure under ERISA. As permitted by ERISA Section 103(a)(3)(C), our audit need not extend

to any statements or information related to assets held for investment of the plan (investment

information) by a bank or similar institution or insurance carrier that is regulated, supervised, and

subject to periodic examination by a state or federal agency, provided that the statements or

information regarding assets so held are prepared and certified to by the bank or similar institution

or insurance carrier in accordance with 29 CFR 2520.103-5 of the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA (qualified institution).

Management has obtained a certification from a qualified institution as of and for the year ended

December 31, 2021, stating that the certified investment information, as described in Note X to the

financial statements, is complete and accurate.

5

Opinion on the 2021 Financial Statements

In our opinion, based on our audit and on the procedures performed as described in the Auditor's

Responsibilities for the Audit of the 2021 Financial Statements section

• the amounts and disclosures in the accompanying 2021 financial statements, other than

those agreed to or derived from the certified investment information, are presented fairly,

in all material respects, in accordance with accounting principles generally accepted in the

United States of America.

3

This illustration reflects the audit of the 2021 financial statements as the first year of implementation of SAS No.

136, Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA, as

amended. The inclusion of the year “2021” throughout this example is for illustrative purposes to easily identify

the period covered. The inclusion of the date is not required. See AU-C section 703, Forming an Opinion and

Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA, for requirements relating to

appropriate headings.

4

The auditor is required to identify the title of each statement that the financial statements comprise. Accordingly,

this illustration would be revised to reflect the specific circumstances of each engagement.

5

If the note to the financial statements does not identify the names of the qualified certifying institutions and

periods covered, then such information may be included in the auditor's report.

© 2021 AICPA. All rights reserved.

• the information in the accompanying 2021 financial statements related to assets held by

6

and certified to by a qualified institution agrees to, or is derived from, in all material

respects, the information prepared and certified by an institution that management

determined meets the requirements of ERISA Section 103(a)(3)(C).

Basis for Opinion on the 2021 Financial Statements

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America (GAAS). Our responsibilities under those standards are further described in the

Auditor's Responsibilities for the Audit of the 2021 Financial Statements section of our report. We

are required to be independent of ABC 401(k) Plan and to meet our other ethical responsibilities, in

accordance with the relevant ethical requirements relating to our audits. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide a basis for our ERISA Section

103(a)(3)(C) audit opinion.

Responsibilities of Management for the 2021 Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in

accordance with accounting principles generally accepted in the United States of America, and for

the design, implementation, and maintenance of internal control relevant to the preparation and

fair presentation of financial statements that are free from material misstatement, whether due to

fraud or error. Management's election of the ERISA Section 103(a)(3)(C) audit does not affect

management's responsibility for the financial statements.

In preparing the financial statements, management is required to evaluate whether there are

conditions or events, considered in the aggregate, that raise substantial doubt about ABC 401(k)

Plan's ability to continue as a going concern for [insert the time period set by the applicable financial

reporting framework].

7

Management is also responsible for maintaining a current plan instrument, including all plan

amendments, administering the plan, and determining that the plan's transactions that are

presented and disclosed in the financial statements are in conformity with the plan's provisions,

including maintaining sufficient records with respect to each of the participants, to determine the

benefits due or which may become due to such participants.

Auditor’s Responsibilities for the Audit of the 2021 Financial Statements

Except as described in the Scope and Nature of the ERISA Section 103(a)(3)(C) Audit of the 2021

Financial Statements section of our report, our objectives are to obtain reasonable assurance about

6

This sentence may need to be modified when the certification is provided by an insurance entity, which provides

benefits under the plan or holds plan assets.

7

When the financial statements are prepared in accordance with accounting principles generally accepted in the

United States of America as promulgated by FASB, management is required to evaluate whether there are

conditions and events, considered in the aggregate, that raise substantial doubt about an entity’s ability to

continue as a going concern within one year after the date that the financial statements are issued (or within one

year after the financial statements are available to be issued when applicable).

© 2021 AICPA. All rights reserved.

whether the financial statements as a whole are free from material misstatement, whether due to

fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a

high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit

conducted in accordance with GAAS will always detect a material misstatement when it exists. The

risk of not detecting a material misstatement resulting from fraud is higher than for one resulting

from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the

override of internal control. Misstatements are considered material if, there is a substantial

likelihood that, individually or in the aggregate, they would influence the judgment made by a

reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether

due to fraud or error, and design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence regarding the amounts and

disclosures in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of ABC 401(k) Plan's internal control. Accordingly, no such

opinion is expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of

significant accounting estimates made by management, as well as evaluate the overall

presentation of the financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the

aggregate, that raise substantial doubt about ABC 401(k) Plan's ability to continue as a going

concern for a reasonable period of time.

Our audit did not extend to the certified investment information, except for obtaining and reading

the certification, comparing the certified investment information with the related information

presented and disclosed in the 2021 financial statements, and reading the disclosures relating to the

certified investment information to assess whether they are in accordance with the presentation

and disclosure requirements of accounting principles generally accepted in the United States of

America.

Accordingly, the objective of an ERISA Section 103(a)(3)(C) audit is not to express an opinion about

whether the financial statements as a whole are presented fairly, in all material respects, in

accordance with accounting principles generally accepted in the United States of America.

We are required to communicate with those charged with governance regarding, among other

matters, the planned scope and timing of the audit, significant audit findings, and certain internal

control-related matters that we identified during the audit.

© 2021 AICPA. All rights reserved.

Other Matters

2021 Supplemental Schedules Required by ERISA

8

The supplemental schedules of [identify the title of supplemental schedules and periods covered],

are presented for purposes of additional analysis and are not a required part of the financial

statements but are supplementary information required by the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. Such information is the responsibility of

management and was derived from and relates directly to the underlying accounting and other

records used to prepare the financial statements. The information included in the supplemental

schedules, other than that agreed to or derived from the certified investment information, has been

subjected to auditing procedures applied in the audit of the financial statements and certain

additional procedures, including comparing and reconciling such information directly to the

underlying accounting and other records used to prepare the financial statements or to the financial

statements themselves, and other additional procedures in accordance with GAAS. For information

included in the supplemental schedules that agreed to or is derived from the certified investment

information, we compared such information to the related certified investment information.

In forming our opinion on the supplemental schedules, we evaluated whether the supplemental

schedules, other than the information agreed to or derived from the certified investment

information, including their form and content, are presented in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

In our opinion

• the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment

information, are presented, in all material respects, in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

• the information in the supplemental schedules related to assets held by

9

and certified to by

a qualified institution agrees to, or is derived from, in all material respects, the information

prepared and certified by an institution that management determined meets the

requirements of ERISA Section 103(a)(3)(C).

Auditor’s Report on the 2020 Financial Statements

We were engaged to audit the 2020 financial statements of ABC 401(k) Plan. As permitted by 29

CFR 2520.103-8 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure

under ERISA, the plan administrator instructed us not to perform and we did not perform any

8

Paragraph .A14 of AU-C section 706, Emphasis-of-Matter Paragraphs and Other-Matter Paragraphs in the

Independent Auditor’s Report, addresses the placement of emphasis-of-matter and other-matter paragraphs in the

auditor’s report. For purposes of this illustration, this paragraph has been placed at the end of the report. For an

ERISA section 103(a)(3)(C) audit, the auditor is required to report on the ERISA-required supplemental schedules in

an other-matter paragraph.

9

See footnote 5.

© 2021 AICPA. All rights reserved.

auditing procedures with respect to the information certified by a qualified institution. In our report

dated [insert prior year report date], we indicated that (a) because of the significance of the

information that we did not audit, we were not able to obtain sufficient appropriate audit evidence

to provide a basis for an audit opinion and accordingly, we did not express an opinion on the 2020

financial statements, and (b) the form and content of the information included in the 2020 financial

statements other than that derived from the certified information were presented in compliance

with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA.

[Signature of the auditor's firm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

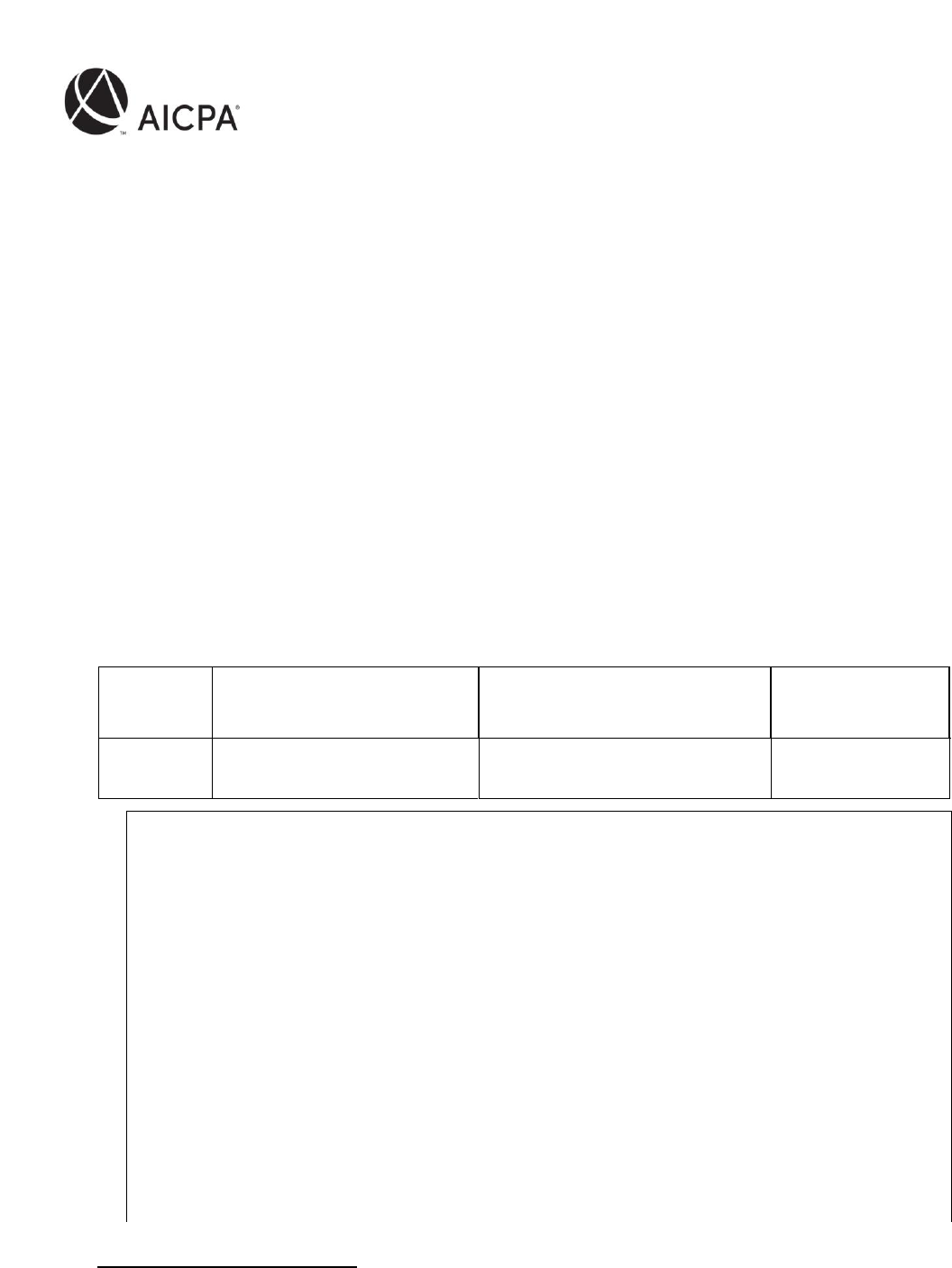

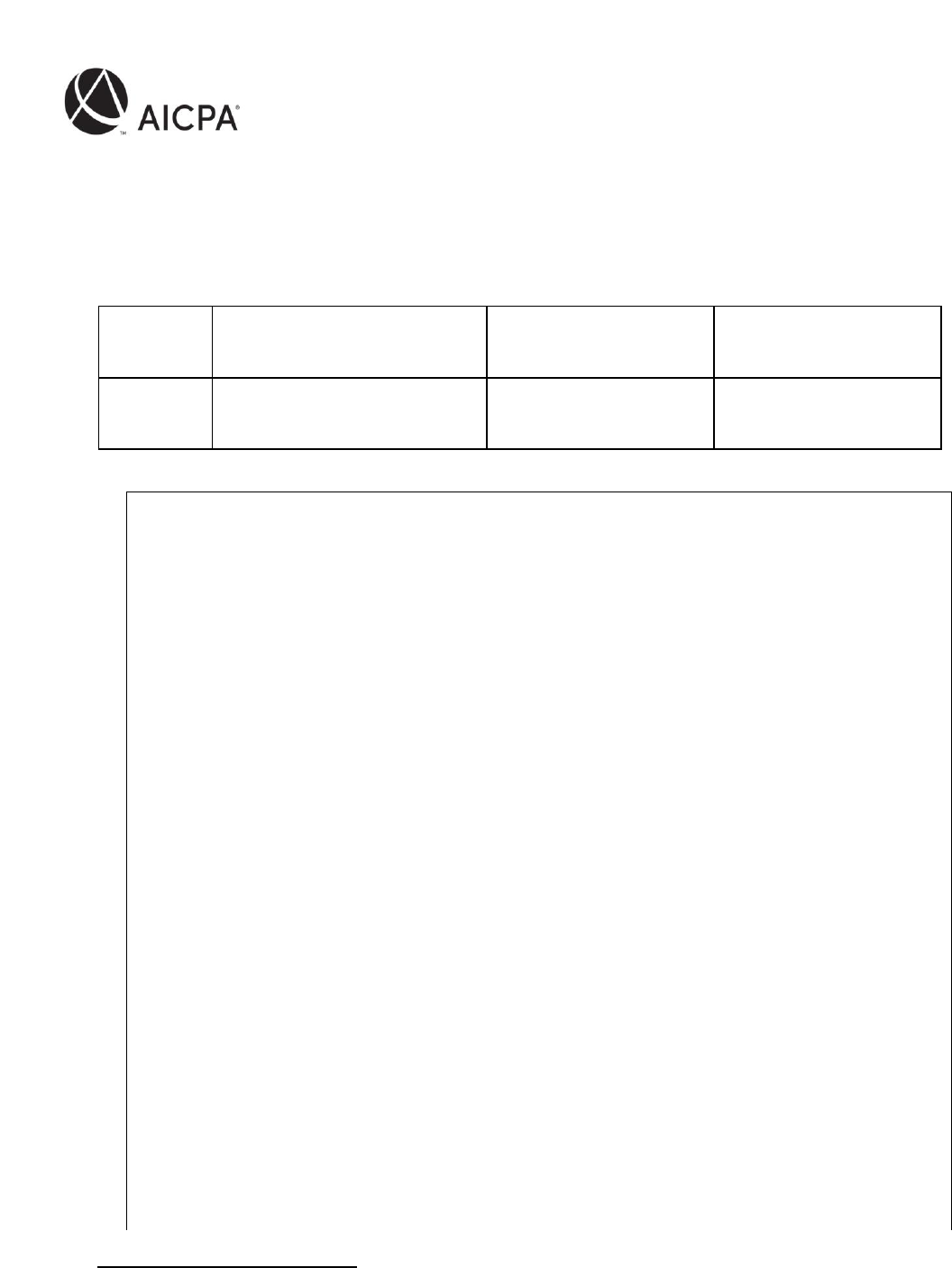

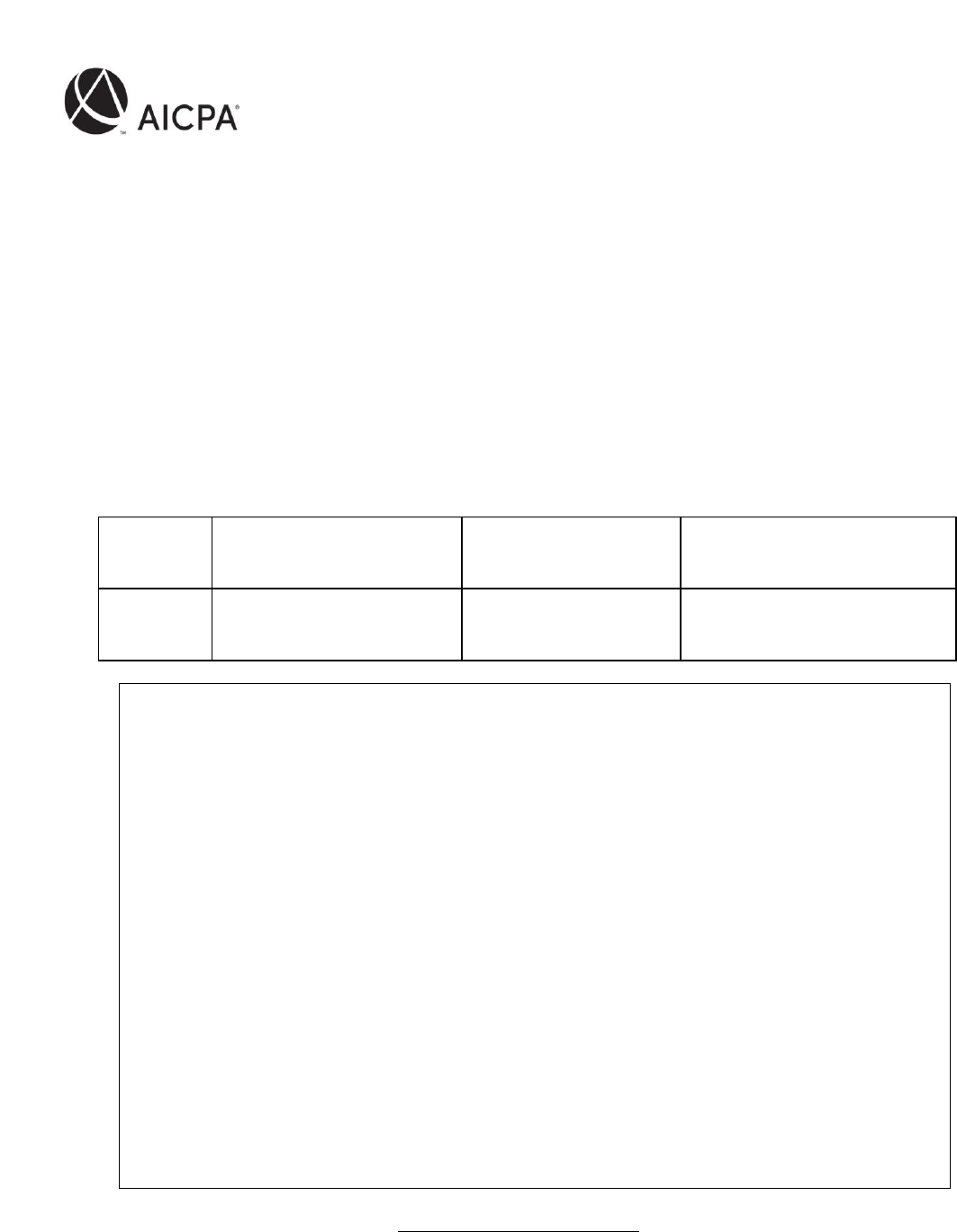

Illustration 1-2

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type of audit

Conditions

401(k)

ERISA Section 103(a)(3)(C)

Full scope

(unmodified opinion)

Continuing auditor

Circumstances include the following:

• Management elected an ERISA Section 103(a)(3)(C) audit for the 2021 plan year financial

statements as permitted by Code of Federal Regulations (CFR), Labor, Title 29, Section 2520.103-8

of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

10

• The auditor performed an ERISA Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

• The auditor has concluded that the ERISA Section 103(a)(3)(C) report is appropriate as of and for

the year ended December 31, 2021 based on the audit evidence obtained.

• The auditor performed a full-scope audit and issued an unmodified (“clean”) opinion on the prior

year financial statements (for the year ended December 31, 2020).

• The auditor is issuing one report by referring to the prior year report in an other-matter

paragraph. In such situations, the auditor typically requests plan management to provide written

representations for both years (see paragraph .A127 of AU-C section 703).

10

See footnote 2.

© 2021 AICPA. All rights reserved.

• The report on the 2021 ERISA-required supplemental schedules is presented as an other-matter

paragraph in accordance with paragraph .132 of AU-C section 703. The auditor has concluded

that the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment information, is

presented, in all material respects, in conformity with the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. The information in the supplemental

schedules related to assets held by and certified to by a qualified institution agreed to or is

derived from, in all material respects, the information prepared and certified by an institution that

management determined meets the requirements of ERISA Section 103(a)(3)(C).

Independent Auditor’s Report

[Appropriate Addressee]

[Same “Scope and Nature of the ERISA Section 103(a)(3)(C) Audit for the 2021 Financial Statements,”

“Opinion on the 2021 Financial Statements,” “Basis for the Opinion on the 2021 Financial

Statements,” “Responsibilities of Management for the 2021 Financial Statements,” and “Auditor’s

Responsibilities for the Audit of the 2021 Financial Statements,” sections as in illustration 1-1.]

Other Matters

2021 Supplemental Schedules Required by ERISA

11

The supplemental schedules of [identify the title of supplemental schedules and periods covered],

are presented for purposes of additional analysis and are not a required part of the financial

statements but are supplementary information required by the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. Such information is the responsibility of

management and was derived from and relates directly to the underlying accounting and other

records used to prepare the financial statements. The information included in the supplemental

schedules, other than that agreed to or derived from the certified investment information, has been

subjected to auditing procedures applied in the audit of the financial statements and certain

additional procedures, including comparing and reconciling such information directly to the

underlying accounting and other records used to prepare the financial statements or to the financial

statements themselves, and other additional procedures in accordance with GAAS. For information

included in the supplemental schedules that agreed to or is derived from the certified investment

information, we compared such information to the related certified investment information.

In forming our opinion on the supplemental schedules, we evaluated whether the supplemental

schedules, other than the information agreed to or derived from the certified investment

information, including their form and content, are presented in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

In our opinion

11

See footnote 8.

© 2021 AICPA. All rights reserved.

• the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment

information, are presented, in all material respects, in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

• the information in the supplemental schedules related to assets held by

12

and certified to by

a qualified institution agrees to, or is derived from, in all material respects, the information

prepared and certified by an institution that management determined meets the

requirements of ERISA Section 103(a)(3)(C).

Auditor’s Report on the 2020 Financial Statements

We have audited the statement of net assets available for benefits of ABC 401(k) Plan as of

December 31, 2020 and the related statement of changes in net assets available for benefits for the

year ended December 31, 2020 (not presented herein), and in our report dated [insert prior year

report date], we expressed an unmodified opinion on those financial statements.

[Signature of the auditor's firm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

Illustration 1-3

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type of

audit

Conditions

401(k)

Non-Section 103(a)(3)(C)

(unmodified opinion)

Limited scope

(disclaimer of opinion)

Continuing auditor

Circumstances include the following:

• The auditor performed a non-Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

12

See footnote 5.

© 2021 AICPA. All rights reserved.

• The auditor has concluded that an unmodified (“clean”) opinion on the ERISA plan financial

statements is appropriate based on the audit evidence obtained.

• The auditor performed a limited-scope audit and disclaimed an opinion on the prior year financial

statements (for the year ended December 31, 2020).

• The auditor is issuing one report by referring to the prior year report in an other-matter

paragraph. In such situations, the auditor typically requests plan management to provide written

representations for both years (see paragraph .A127 of AU-C section 703).

• The report on the 2021 ERISA-required supplemental schedules is presented in a separate section

in accordance with paragraphs .129−.130 of AU-C section 703. The auditor has concluded that the

information in the 2021 ERISA-required supplemental schedules is fairly stated, in all material

respects, in relation to the financial statements as a whole, and the form and content are

presented in conformity with the Department of Labor's Rules and Regulations for Reporting and

Disclosure under ERISA.

Independent Auditor’s Report

[Appropriate Addressee]

Opinion on the 2021 Financial Statements

13

We have audited the financial statements of ABC 401(k) Plan, an employee benefit plan subject to

the Employee Retirement Income Security Act of 1974 (ERISA), which comprise the statement of net

assets available for benefits as of December 31, 2021, and the related statement of changes in net

assets available for benefits for the year then ended, and the related notes to the financial

statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the net

assets available for benefits of ABC 401(k) Plan as of December 31, 2021, and the changes in its net

assets available for benefits for the year then ended, in accordance with accounting principles

generally accepted in the United States of America.

Basis for Opinion on the 2021 Financial Statements

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America (GAAS). Our responsibilities under those standards are further described in the

Auditor’s Responsibilities for the Audit of the 2021 Financial Statements section of our report. We are

required to be independent of ABC 401(k) Plan and to meet our other ethical responsibilities, in

accordance with the relevant ethical requirements relating to our audits. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

13

See footnote 3.

© 2021 AICPA. All rights reserved.

Responsibilities of Management for the 2021 Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in

accordance with accounting principles generally accepted in the United States of America, and for

the design, implementation, and maintenance of internal control relevant to the preparation and

fair presentation of financial statements that are free from material misstatement, whether due to

fraud or error.

In preparing the financial statements, management is required to evaluate whether there are

conditions or events, considered in the aggregate, that raise substantial doubt about ABC 401(k)

Plan’s ability to continue as a going concern for [insert the time period set by the applicable financial

reporting framework].

Management is also responsible for maintaining a current plan instrument, including all plan

amendments, administering the plan, and determining that the plan’s transactions that are

presented and disclosed in the financial statements are in conformity with the plan’s provisions,

including maintaining sufficient records with respect to each of the participants, to determine the

benefits due or which may become due to such participants.

Auditor’s Responsibilities for the Audit of the 2021 Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a

whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s

report that includes our opinion. Reasonable assurance is a high level of assurance but is not

absolute assurance and therefore is not a guarantee that an audit conducted in accordance with

GAAS will always detect a material misstatement when it exists. The risk of not detecting a material

misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve

collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Misstatements are considered material if, individually or in the aggregate, they could reasonably be

expected to influence the economic decisions of users made on the basis of these financial

statements.

In performing an audit in accordance with GAAS, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether

due to fraud or error, and design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence regarding the amounts and

disclosures in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing

© 2021 AICPA. All rights reserved.

an opinion on the effectiveness of ABC 401(k) Plan’s internal control. Accordingly, no such

opinion is expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of

significant accounting estimates made by management, as well as evaluate the overall

presentation of the financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the

aggregate, that raise substantial doubt about ABC 401(k) Plan’s ability to continue as a going

concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other

matters, the planned scope and timing of the audit, significant audit findings, and certain internal

control-related matters that we identified during the audit.

2021 Supplemental Schedules Required by ERISA

14

Our audit was conducted for the purpose of forming an opinion on the financial statements as a

whole. The supplemental schedules of [identify title of supplemental schedules and periods covered]

are presented for purposes of additional analysis and are not a required part of the financial

statements but are supplementary information required by the Department of Labor’s Rules and

Regulations for Reporting and Disclosure under ERISA. Such information is the responsibility of

management and was derived from and relates directly to the underlying accounting and other

records used to prepare the financial statements. The information has been subjected to the

auditing procedures applied in the audits of the financial statements and certain additional

procedures, including comparing and reconciling such information directly to the underlying

accounting and other records used to prepare the financial statements or to the financial

statements themselves, and other additional procedures in accordance with GAAS.

In forming our opinion on the supplemental schedules, we evaluated whether the supplemental

schedules, including their form and content, are presented in conformity with the Department of

Labor’s Rules and Regulations for Reporting and Disclosure under ERISA.

In our opinion, the information in the accompanying schedules is fairly stated, in all material

respects, in relation to the financial statements as a whole, and the form and content are presented

in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure

under ERISA.

Other Matter

Auditor’s Report on the 2020 Financial Statements

14

See footnote 8.

© 2021 AICPA. All rights reserved.

We were engaged to audit the 2020 financial statements of ABC 401(k) Plan. As permitted by 29

CFR 2520.103-8 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure

under ERISA, the plan administrator instructed us not to perform and we did not perform any

auditing procedures with respect to the information certified by a qualified institution. In our report

dated [insert prior year report date], we indicated that (a) because of the significance of the

information that we did not audit, we were not able to obtain sufficient appropriate audit evidence

to provide a basis for an audit opinion and accordingly, we did not express an opinion on the 2020

financial statements, and (b) the form and content of the information included in the 2020 financial

statements other than that derived from the certified information were presented in compliance

with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA.

[Signature of the auditor’s firm]

[City and state where the auditor’s report is issued]

[Date of the auditor’s report]

Illustration 1-4

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type

of audit

Conditions

401(k)

Non-Section 103(a)(3)(C)

(unmodified opinion)

Full scope

(unmodified opinion)

Continuing auditor

Circumstances include the following:

• The auditor performed a non-Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

• The auditor has concluded that an unmodified (“clean”) opinion on the ERISA plan financial

statements is appropriate based on the audit evidence obtained.

• The auditor performed a full-scope audit and issued an unmodified (“clean”) opinion on the prior

year financial statements (for the year ended December 31, 2020).

• In accordance with paragraph .86 of AU-C section 703, when the auditor is expressing an opinion

on all periods presented, a continuing auditor should update the report on the financial

statements of one or more prior periods presented on a comparative basis with those of the

current period. When issuing an updated report, the information considered by the continuing

© 2021 AICPA. All rights reserved.

auditor is that which the auditor becomes aware of during the audit of the current period

financial statements. An updated report issued in conjunction with the auditor’s report on the

current period financial statements. In this situation, because the auditor performed a full-scope

audit in the prior year and is performing a non-Section 103(a)(3)(C) audit in the current year, the

auditor would have obtained sufficient appropriate audit evidence in each year in which to

conclude whether the financial statements are fairly presented, in all material respects.

Accordingly, the auditor has concluded that the standard form of report is appropriate provided

the auditor has updated the prior year report as discussed previously.

• The report on the 2021 ERISA-required supplemental schedules is presented in a separate section

in accordance with paragraphs .129−.130 of AU-C section 703. The auditor has concluded that

the information in the 2021 ERISA-required supplemental schedules is fairly stated, in all material

respects, in relation to the financial statements as a whole, and the form and content are

presented in conformity with the Department of Labor's Rules and Regulations for Reporting and

Disclosure under ERISA.

When a continuing auditor performed a full-scope audit of comparative ERISA plan financial statements

in the prior year and a non-Section 103(a)(3)(C) audit in the current year (the initial year of

implementation of the EBP SAS, as amended), the continuing auditor updates their prior year report in

accordance with paragraph .86 of AU-C section 703. This would result in issuing one report that refers to

each period for which the financial statements are presented and on which the auditor is expressing an

opinion (for example, for the year ended December 31, 2021 and 2020). This would not differ from the

form of report when the auditor performs a non-Section 103(a)(3)(C) audit in both years. Illustration 1

from exhibit A of AU-C section 703 (also shown in chapter 11 of AICPA Audit and Accounting Guide

Employee Benefit Plans) contains such an example.

Paragraph .86 of AU-C section 703 states that when expressing an opinion on all periods presented, a

continuing auditor should update the report on the financial statements of one or more prior periods

presented on a comparative basis with those of the current period. The auditor’s report on comparative

financial statements should not be dated earlier than the date on which the auditor has obtained

sufficient appropriate audit evidence on which to support the opinion for the most recent audit.

Paragraph .A125 of AU-C section 703 explains that an updated report on prior period financial

statements is distinguished from a reissuance of a previous report. When issuing an updated report, the

information considered by the continuing auditor is that which the auditor has become aware of during

the audit of the current period financial statements. An updated report is issued in conjunction with the

auditor’s report on the current period financial statements.

Illustration 1-5

© 2021 AICPA. All rights reserved.

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type of audit

Conditions

403(b)

ERISA Section 103(a)(3)(C)

with a limitation on the

scope of the audit

(disclaimer of opinion)

Limited scope with respect to investment

information and additional limitation on

the scope of the audit

(disclaimer of opinion)

Continuing

auditor

Circumstances include the following:

• Management elected an ERISA Section 103(a)(3)(C) audit for the 2021 plan year financial

statements as permitted by the Code of Federal Regulations (CFR), Labor, Title 29, Section

2520.103-8 of the Department of Labor's Rules and Regulations for Reporting and Disclosure

under ERISA.

15

• The auditor performed an ERISA Section 103(a)(3)(C) audit as of and for the year ended

December 31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140

for the December 31, 2021 plan year.

• The auditor had concluded to disclaim an opinion on the 2021 financial statements because

the Plan has not maintained sufficient accounting records and supporting documents relating

to certain annuity contracts and custodial accounts issued to current and former employees

prior to January 1, 2009.

• Further, the Plan has excluded from investments in the accompanying statements of net assets

available for benefits certain annuity contracts and custodial accounts issued to current and

former employees prior to January 1, 2009, as permitted by the Department of Labor's Field

Assistance Bulletin No. 2009-02, Annual Reporting Requirements for 403(b) Plans.

• The auditor has concluded that ERISA Section 103(a)(3)(C) report with a disclaimer of opinion is

appropriate as of and for the year ended December 31, 2021 based on the audit evidence

obtained.

• In the prior year, the auditor performed a limited-scope audit and disclaimed an opinion on the

prior year financial statements (for the year ended December 31, 2020) due to lack of sufficient

books and records and excluded contracts.

• The auditor is issuing one report by referring to the prior year report in an other-matter

paragraph. In such situations, the auditor typically requests plan management to provide

written representations for both years (see paragraph .A127 of AU-C section 703).

15

See footnote 2.

© 2021 AICPA. All rights reserved.

• The report on the 2021 ERISA-required supplemental schedules is presented as an other-matter

paragraph in accordance with paragraph .132 of AU-C section 703. In accordance with

paragraph .132(i) of AU-C section 703, the auditor is precluded from expressing an opinion on

the supplemental schedules when the auditor’s report on the ERISA plan financial statements

contains a disclaimer of opinion.

Independent Auditor's Report

[Appropriate Addressee]

Scope and Nature of the ERISA Section 103(a)(3)(C) Audit for the 2021 Financial Statements

16

We were engaged to perform an audit of the financial statements of XYZ 403(b) Plan, an employee

benefit plan subject to the Employee Retirement Income Security Act of 1974 (ERISA), as permitted

by ERISA Section 103(a)(3)(C) (ERISA Section 103(a)(3)(C) audit). The financial statements comprise

the statement of net assets available for benefits as of December 31, 2021, and the related

statement of changes in net assets available for benefits for the year ended December 31, 2021, and

the related notes to the financial statements.

Management, having determined it is permissible in the circumstances, has elected to have the

audit of XYZ 403(b) Plan's 2021 financial statements performed in accordance with ERISA Section

103(a)(3)(C) pursuant to 29 CFR 2520.103-8 of the Department of Labor's Rules and Regulations for

Reporting and Disclosure under ERISA. As permitted by ERISA Section 103(a)(3)(C), our audit need

not extend to any statements or information related to assets held for investment of the plan

(investment information) by a bank or similar institution or insurance carrier that is regulated,

supervised, and subject to periodic examination by a state or federal agency, provided that the

statements or information regarding assets so held are prepared and certified to by the bank or

similar institution or insurance carrier in accordance with 29 CFR 2520.103-5 of the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA (qualified institution).

Management has obtained a certification from a qualified institution as of and for the year ended

December 31, 2021 stating that the certified investment information, as described in Note X to the

financial statements, is complete and accurate.

17

Disclaimer of Opinion on the 2021 Financial Statements

We do not express an opinion on the accompanying 2021 financial statements of XYZ 403(b) Plan.

Because of the significance of the matters described in the Basis for Disclaimer of Opinion for the

2021 Financial Statements section of our report, we have not been able to obtain sufficient

appropriate audit evidence to provide a basis for an audit opinion on the financial statements.

16

See footnote 3.

17

See footnote 5.

© 2021 AICPA. All rights reserved.

Basis for Disclaimer of Opinion on the 2021 Financial Statements

XYZ 403(b) Plan has not maintained sufficient accounting records and supporting documents relating

to certain annuity contracts and custodial accounts issued to current and former employees prior to

January 1, 2009. Accordingly, we were unable to apply auditing procedures sufficient to determine

the extent to which the accompanying financial statements may have been affected by these

conditions.

Further, as described in Note Y to the financial statements, the XYZ 403(b) Plan has excluded from

investments in the accompanying statement of net assets available for benefits certain annuity

contracts and custodial accounts issued to current and former employees prior to January 1, 2009,

as permitted by the Department of Labor's Field Assistance Bulletin No. 2009-02, Annual Reporting

Requirements for 403(b) Plans. The investment income and distributions related to such accounts

have also been excluded in the accompanying statement of changes in net assets available for

benefits. The amount of these excluded annuity contracts and custodial accounts and the related

income and distributions are not reasonably determinable. Accounting principles generally accepted

in the United States of America require that these accounts and the related income and

distributions be included in the accompanying financial statements.

Responsibilities of Management for the 2021 Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in

accordance with accounting principles generally accepted in the United States of America, and for

the design, implementation, and maintenance of internal control relevant to the preparation and

fair presentation of financial statements that are free from material misstatement, whether due to

fraud or error. Management's election of the ERISA Section 103(a)(3)(C) audit does not affect

management's responsibility for the financial statements.

In preparing the financial statements, management is required to evaluate whether there are

conditions or events, considered in the aggregate, that raise substantial doubt about XYZ 403(b)

Plan's ability to continue as a going concern for [insert the time period set by the applicable financial

reporting framework].

Management is also responsible for maintaining a current plan instrument, including all plan

amendments, administering the plan, and determining that the plan's transactions that are

presented and disclosed in the financial statements are in conformity with the plan's provisions,

including maintaining sufficient records with respect to each of the participants, to determine the

benefits due or which may become due to such participants.

Auditor’s Responsibilities for the Audit of the 2021 Financial Statements

Our responsibility is to conduct an audit of XYZ 403(b) Plan's financial statements in accordance with

auditing standards generally accepted in the United States of America and to issue an auditor's

report. However, because of the matters described in the Basis for Disclaimer of Opinion on the

© 2021 AICPA. All rights reserved.

2021 Financial Statements section of our report, we were not able to obtain sufficient appropriate

audit evidence to provide a basis for an audit opinion on these financial statements.

We are required to be independent of XYZ 403(b) Plan, and to meet our other ethical

responsibilities, in accordance with the relevant ethical requirements relating to our audit.

Other Matters

2021 Supplemental Schedules Required by ERISA

The supplemental schedules of [identify the title of supplemental schedules and periods covered] are

presented for purposes of additional analysis and are not a required part of the financial statements

but are supplementary information required by the Department of Labor's Rules and Regulations for

Reporting and Disclosure under ERISA. Such information is the responsibility of management and

was derived from and relates directly to the underlying accounting and other records used to

prepare the financial statements. Because of the significance of the matters described in the Basis

for Disclaimer of Opinion for the 2021 Financial Statements section of our report, it is inappropriate

to and we do not express an opinion on these supplemental schedules.

Auditor’s Report on the 2020 Financial Statements

We were engaged to audit the 2020 financial statements of XYZ 403(b) Plan. As permitted by 29 CFR

2520.103-8 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under

ERISA, the plan administrator instructed us not to perform, and we did not perform, any auditing

procedures with respect to the information certified by a qualified institution. Further, XYZ 403(b)

Plan has not maintained sufficient accounting records and supporting documents relating to certain

annuity contracts and custodial accounts issued to current and former employees prior to January 1,

2009. Accordingly, we were unable to apply auditing procedures sufficient to determine the extent

to which the accompanying financial statements may have been affected by these conditions.

XYZ 403(b) Plan has excluded from the 2020 financial statements certain annuity contracts and

custodial accounts issued to current and former employees prior to January 1, 2009, as permitted by

the Department of Labor's Field Assistance Bulletin No. 2009-02, Annual Reporting Requirements for

403(b) Plans. The investment income and distributions related to such accounts have also been

excluded from the 2020 financial statements. The amount of these excluded annuity contracts and

custodial accounts and the related income and distributions are not determinable. Accounting

principles generally accepted in the United States of America require that these accounts and the

related income and distributions be included in the 2020 financial statements.

In our report dated [insert date of prior year auditor’s report], we indicated that because of the

significance of the information that we did not audit, we were not able to obtain sufficient

appropriate audit evidence to provide a basis for an audit opinion and accordingly, we did not

express an opinion on the 2020 financial statements.

© 2021 AICPA. All rights reserved.

[Signature of the auditor's firm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

© 2021 AICPA. All rights reserved.

Predecessor Auditor Situations

Illustration 1-6

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type

of audit

Conditions

401(k)

ERISA Section 103(a)(3)(C)

Limited scope

(disclaimer of opinion)

Prior period audited by

predecessor auditor

Circumstances include the following:

• Management elected an ERISA Section 103(a)(3)(C) audit for the 2021 plan year financial

statements as permitted by Code of Federal Regulations (CFR), Labor, Title 29, Section 2520.103-8

of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

18

• The auditor performed an ERISA Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

• The auditor has concluded that the ERISA Section 103(a)(3)(C) report is appropriate as of and for

the year ended December 31, 2021 based on the audit evidence obtained.

• Predecessor auditors performed a limited-scope audit and disclaimed an opinion on the prior year

financial statements (for the year ended December 31, 2020).

• Paragraph .93 of AU-C section 703 addresses how to report when the prior period financial

statements are audited by a predecessor auditor, as follows:

.93 If the financial statements of the prior period were audited by a predecessor auditor, and the

predecessor auditor’s report on the prior period’s financial statements is not reissued, in addition to

expressing an opinion on the current period’s financial statements, the auditor should state the

following in an other-matter paragraph:

(a) That the financial statements of the prior period were audited by a predecessor auditor

(b) The type of opinion expressed by the predecessor auditor and, if the opinion was modified, the

reasons therefore

(c) The nature of an emphasis-of-matter paragraph or other-matter paragraph included in the

predecessor auditor’s report, if any

(d) The date of that report

• The report on the 2021 ERISA-required supplemental schedules is presented as an other-matter

paragraph in accordance with paragraph .132 of AU-C section 703. The auditor has concluded

18

See footnote 2.

© 2021 AICPA. All rights reserved.

that the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment information, is

presented, in all material respects, in conformity with the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. The information in the supplemental

schedules related to assets held by and certified to by a qualified institution agreed to or is

derived from, in all material respects, the information prepared and certified by an institution that

management determined meets the requirements of ERISA Section 103(a)(3)(C).

Independent Auditor’s Report

[Appropriate Addressee]

[Same “Scope and Nature of the ERISA Section 103(a)(3)(C) Audit for the 2021 Financial Statements,”

“Opinion on the 2021 Financial Statements,” “Basis for the Opinion on the 2021 Financial

Statements,” “Responsibilities of Management for the 2021 Financial Statements,” and “Auditor’s

Responsibilities for the Audit of the 2021 Financial Statements,” sections as in illustration 1-1.]

Other Matters

19

2021 Supplemental Schedules Required by ERISA

The supplemental schedules of [identify the title of supplemental schedules and periods covered],

are presented for purposes of additional analysis and are not a required part of the financial

statements but are supplementary information required by the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. Such information is the responsibility of

management and was derived from and relates directly to the underlying accounting and other

records used to prepare the financial statements. The information included in the supplemental

schedules, other than that agreed to or derived from the certified investment information, has been

subjected to auditing procedures applied in the audit of the financial statements and certain

additional procedures, including comparing and reconciling such information directly to the

underlying accounting and other records used to prepare the financial statements or to the financial

statements themselves, and other additional procedures in accordance with GAAS. For information

included in the supplemental schedules that agreed to or is derived from the certified investment

information, we compared such information to the related certified investment information.

In forming our opinion on the supplemental schedules, we evaluated whether the supplemental

schedules, other than the information agreed to or derived from the certified investment

information, including their form and content, are presented in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

In our opinion

• the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment

19

See footnote 8.

© 2021 AICPA. All rights reserved.

information, are presented, in all material respects, in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

• the information in the supplemental schedules related to assets held by

20

and certified to by

a qualified institution agrees to, or is derived from, in all material respects, the information

prepared and certified by an institution that management determined meets the

requirements of ERISA Section 103(a)(3)(C).

Auditor’s Report on the 2020 Financial Statements

The 2020 financial statements of ABC 401(k) Plan were audited by predecessor auditors. As

permitted by 29 CFR 2520.103-8 of the Department of Labor's Rules and Regulations for Reporting

and Disclosure under ERISA, the plan administrator instructed the predecessor auditor not to

perform, and they did not perform, any auditing procedures with respect to the information

certified by a qualified institution. Their report dated [insert date of predecessor auditor’s report],

indicated that (a) because of the significance of the information that they did not audit, they were

not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion and

accordingly, they did not express an opinion on the financial statements and supplemental

schedules, and (b) the form and content of the information included in the financial statements and

supplemental schedules other than that derived from the certified information, were presented in

compliance with the Department of Labor’s Rules and Regulations for Reporting and Disclosure

under ERISA.

21

[Signature of the auditor's firm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

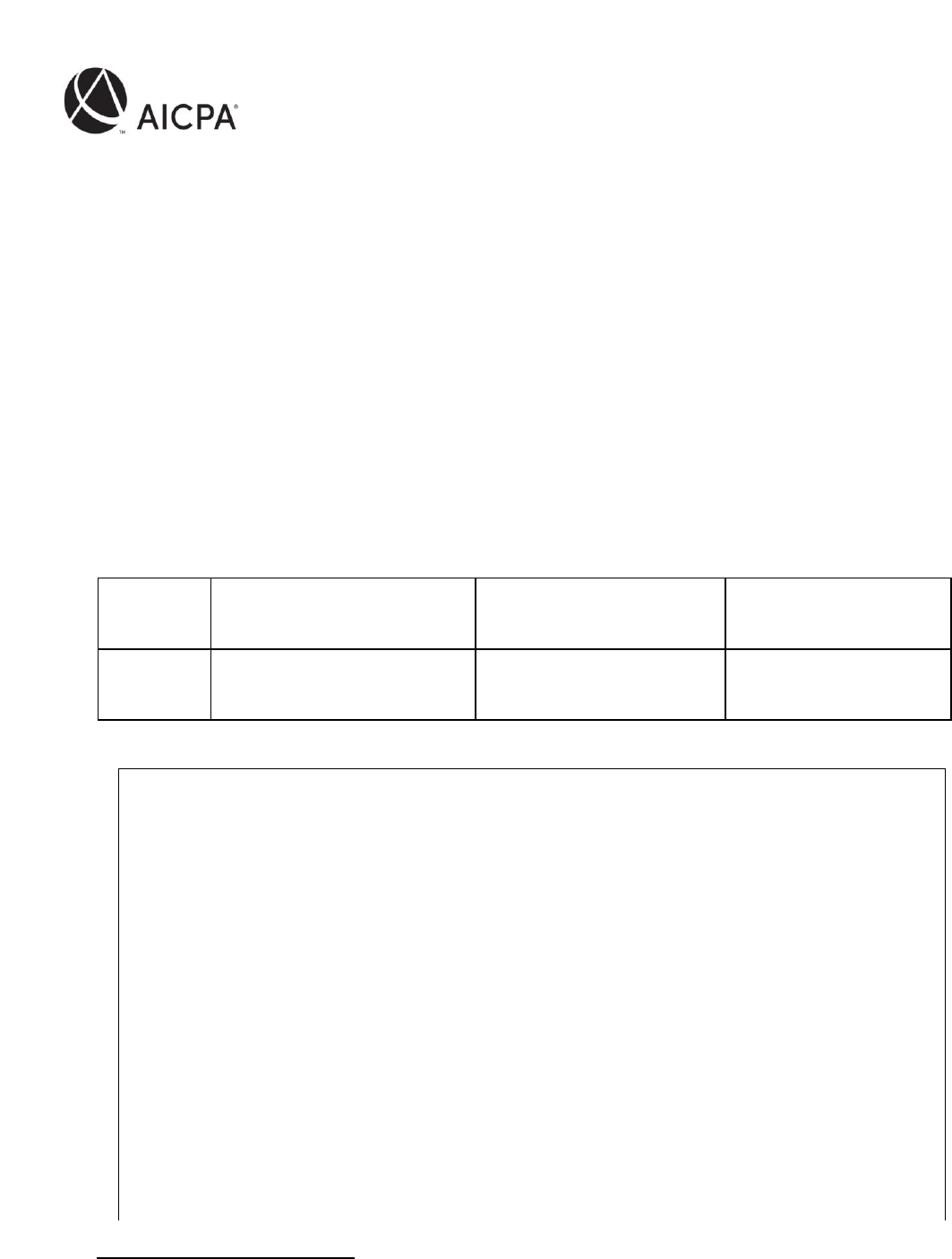

Illustration 1-7

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type of

audit

Conditions

20

See footnote 5.

21

Paragraph .93 of AU-C section 703 addresses how to report when the prior period financial statements are

audited by a predecessor auditor. Among other things, the auditor should state the nature of an emphasis-of-

matter paragraph, other-matter paragraph or going concern section included in the predecessor auditor’s report, if

any.

© 2021 AICPA. All rights reserved.

401(k)

ERISA Section 103(a)(3)(C)

Full scope

(unmodified opinion)

Prior period audited by

predecessor auditor

Circumstances include the following:

• Management elected an ERISA Section 103(a)(3)(C) audit for the 2021 plan year financial

statements as permitted by Code of Federal Regulations (CFR), Labor, Title 29, Section 2520.103-8

of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

22

• The auditor performed an ERISA Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

• The auditor has concluded that the ERISA Section 103(a)(3)(C) report is appropriate as of and for

the year ended December 31, 2021 based on the audit evidence obtained.

• Predecessor auditors performed a full-scope audit in the prior year and issued an unmodified

“clean” opinion on the prior year financial statements (for the year ended December 31, 2020).

• Paragraph .93 of AU-C section 703 addresses how to report when the prior period financial

statements are audited by a predecessor auditor.

• The report on the 2021 ERISA-required supplemental schedules is presented as an other-matter

paragraph in accordance with paragraph .132 of AU-C section 703. The auditor has concluded

that the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment information, is

presented, in all material respects, in conformity with the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. The information in the supplemental

schedules related to assets held by and certified to by a qualified institution agreed to or is

derived from, in all material respects, the information prepared and certified by an institution that

management determined meets the requirements of ERISA Section 103(a)(3)(C).

Independent Auditor’s Report

[Appropriate Addressee]

[Same “Scope and Nature of the ERISA Section 103(a)(3)(C) Audit for the 2021 Financial Statements,”

“Opinion on the 2021 Financial Statements,” “Basis for the Opinion on the 2021 Financial

Statements,” “Responsibilities of Management for the 2021 Financial Statements,” and “Auditor’s

Responsibilities for the Audit of the 2021 Financial Statements,” sections as in illustration 1-1.]

Other Matters

22

See footnote 2.

© 2021 AICPA. All rights reserved.

2021 Supplemental Schedules Required by ERISA

The supplemental schedules of [identify the title of supplemental schedules and periods covered],

are presented for purposes of additional analysis and are not a required part of the financial

statements but are supplementary information required by the Department of Labor's Rules and

Regulations for Reporting and Disclosure under ERISA. Such information is the responsibility of

management and was derived from and relates directly to the underlying accounting and other

records used to prepare the financial statements. The information included in the supplemental

schedules, other than that agreed to or derived from the certified investment information, has been

subjected to auditing procedures applied in the audit of the financial statements and certain

additional procedures, including comparing and reconciling such information directly to the

underlying accounting and other records used to prepare the financial statements or to the

financial statements themselves, and other additional procedures in accordance with GAAS. For

information included in the supplemental schedules that agreed to or is derived from the certified

investment information, we compared such information to the related certified investment

information.

In forming our opinion on the supplemental schedules, we evaluated whether the supplemental

schedules, other than the information agreed to or derived from the certified investment

information, including their form and content, are presented in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

In our opinion

• the form and content of the supplemental schedules, other than the information in the

supplemental schedules that agreed to or is derived from the certified investment

information, are presented, in all material respects, in conformity with the Department of

Labor's Rules and Regulations for Reporting and Disclosure under ERISA.

• the information in the supplemental schedules related to assets held by

23

and certified to by

a qualified institution agrees to, or is derived from, in all material respects, the information

prepared and certified by an institution that management determined meets the

requirements of ERISA Section 103(a)(3)(C).

Auditor’s Report on the 2020 Financial Statements

The 2020 financial statements of ABC 401(k) Plan were audited by predecessor auditors whose

report dated [insert date of predecessor auditor’s report], expressed an unmodified opinion on those

financial statements and included an other-matter paragraph that provided an opinion that the

information in the 2020 supplemental schedules were fairly stated in all material respects in relation

to the financial statements as a whole.

24

23

See footnote 5.

24

See footnote 21.

© 2021 AICPA. All rights reserved.

[Signature of the auditor's firm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

Illustration 1-8

Type of

plan

Current year (2021) – type

of audit

Prior year (2020) – type

of audit

Conditions

401(k)

Non-Section 103(a)(3)(C)

(unmodified opinion)

Limited scope

(disclaimer of opinion)

Prior period audited by

predecessor auditor

Circumstances include the following:

• The auditor performed a non-Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

• The auditor has concluded that an unmodified (“clean”) opinion on the ERISA plan financial

statements is appropriate based on the audit evidence obtained.

• Predecessor auditors performed a limited-scope audit and disclaimed an opinion on the prior year

financial statements (for the year ended December 31, 2020).

• Paragraph .93 of AU-C section 703 addresses how to report when the prior period financial

statements are audited by a predecessor auditor.

• The report on the 2021 ERISA-required supplemental schedules is presented in a separate section

in accordance with paragraphs .129−.130 of AU-C section 703. The auditor has concluded that the

information in the 2021 ERISA-required supplemental schedules is fairly stated, in all material

respects, in relation to the financial statements as a whole, and the form and content are

presented in conformity with the Department of Labor's Rules and Regulations for Reporting and

Disclosure under ERISA.

Independent Auditor’s Report

[Appropriate Addressee]

© 2021 AICPA. All rights reserved.

[Same “Opinion on the 2021 Financial Statements,” “Basis for the Opinion on the 2021 Financial

Statements,” “Responsibilities of Management for the 2021 Financial Statements,” and “Auditor’s

Responsibilities for the Audit of the 2021 Financial Statements,” sections as in illustration 1-3.]

2021 Supplemental Schedules Required by ERISA

25

Our audit was conducted for the purpose of forming an opinion on the financial statements as a

whole. The supplemental schedules of [identify title of supplemental schedules and periods covered]

are presented for purposes of additional analysis and are not a required part of the financial

statements but are supplementary information required by the Department of Labor’s Rules and

Regulations for Reporting and Disclosure under ERISA. Such information is the responsibility of

management and was derived from and relates directly to the underlying accounting and other

records used to prepare the financial statements. The information has been subjected to the

auditing procedures applied in the audits of the financial statements and certain additional

procedures, including comparing and reconciling such information directly to the underlying

accounting and other records used to prepare the financial statements or to the financial

statements themselves, and other additional procedures in accordance with GAAS.

In forming our opinion on the supplemental schedules, we evaluated whether the supplemental

schedules, including their form and content, are presented in conformity with the Department of

Labor’s Rules and Regulations for Reporting and Disclosure under ERISA.

In our opinion, the information in the accompanying schedules is fairly stated, in all material

respects, in relation to the financial statements as a whole, and the form and content are presented

in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure

under ERISA.

Other Matter

Auditor’s Report on the 2020 Financial Statements

The 2020 financial statements of ABC 401(k) Plan were audited by predecessor auditors. As

permitted by 29 CFR 2520.103-8 of the Department of Labor's Rules and Regulations for Reporting

and Disclosure under ERISA, the plan administrator instructed the predecessor auditor not to

perform, and they did not perform, any auditing procedures with respect to the information

certified by a qualified institution. Their report dated [insert date of predecessor auditor’s report],

indicated that (a) because of the significance of the information that they did not audit, they were

not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion and

accordingly, they did not express an opinion on the financial statements and supplemental

schedules, and (b) the form and content of the information included in the financial statements and

supplemental schedules, other than that derived from the information certified by the trustee, were

25

See footnote 8.

© 2021 AICPA. All rights reserved.

presented in compliance with the Department of Labor’s Rules and Regulations for Reporting and

Disclosure under ERISA.

26

[Signature of the auditor’s firm]

[City and state where the auditor’s report is issued]

[Date of the auditor’s report]

Illustration 1-9

Type of

plan

Current year (2021) – type of

audit

Prior year (2020) – type of

audit

Conditions

401(k)

Non-Section 103(a)(3)(C)

(unmodified opinion)

Full scope

(unmodified opinion)

Prior period audited by

predecessor auditor

Circumstances include the following:

• The auditor performed a non-Section 103(a)(3)(C) audit as of and for the year ended December

31, 2021 in accordance with GAAS. The auditor has implemented SAS Nos. 134−140 for the

December 31, 2021 plan year.

• The auditor has concluded that an unmodified (“clean”) opinion on the ERISA plan financial

statements is appropriate based on the audit evidence obtained.

• Predecessor auditors performed a full-scope audit and issued an unmodified opinion on the prior

year financial statements (for the year ended December 31, 2020).

• Paragraph .93 of AU-C section 703 addresses how to report when the prior period financial

statements are audited by a predecessor auditor.

• The report on the 2021 ERISA-required supplemental schedules is presented in a separate section

in accordance with paragraphs .129−.130 of AU-C section 703. The auditor has concluded that the

information in the 2021 ERISA-required supplemental schedules is fairly stated, in all material

respects, in relation to the financial statements as a whole, and the form and content are

26

See footnote 21.

© 2021 AICPA. All rights reserved.

presented in conformity with the Department of Labor's Rules and Regulations for Reporting and