EXECUTION VERSION

NY2:\1923025\03\157TD03!.DOC\73683.1037

AMENDED AND RESTATED PURCHASE AGREEMENT

BY AND BETWEEN

IMD PARENT LLC,

LEHMAN BROTHERS HOLDINGS INC.

AND

THE OTHER SELLERS NAMED HEREIN

_______________

dated as of October 3, 2008

TABLE OF CONTENTS

Page

NY2:\1923025\03\157TD03!.DOC\73683.1037

ARTICLE I DEFINITIONS..................................................................................... 1

1.1 Certain Definitions..................................................................................... 1

1.2 Other Definitional and Interpretive Matters ............................................ 33

ARTICLE II PURCHASE AND SALE OF ASSETS; ASSUMPTION OF

LIABILITIES..................................................................................... 34

2.1 Purchase and Sale of Assets..................................................................... 34

2.2 Excluded Assets....................................................................................... 34

2.3 Assumption of Liabilities......................................................................... 34

2.4 Excluded Liabilities................................................................................. 35

2.5 Assumption, Assignment, Cure Amounts................................................ 37

2.6 Further Conveyances and Assumptions................................................... 38

2.7 Bulk Sales Laws....................................................................................... 40

2.8 Purchase Price.......................................................................................... 40

2.9 Payment of Purchase Price....................................................................... 40

2.10 Pre-Closing Base Purchase Price Adjustment ......................................... 41

2.11 Post-Closing True-Ups............................................................................. 42

ARTICLE III CLOSING AND TERMINATION.................................................... 45

3.1 Closing Date............................................................................................. 45

3.2 Certain Closing Deliveries....................................................................... 45

3.3 Termination of Agreement....................................................................... 46

3.4 Procedure Upon Termination................................................................... 48

3.5 Effect of Termination............................................................................... 48

ARTICLE IV REPRESENTATIONS AND WARRANTIES REGARDING

THE COMPANY GROUP AND THE BUSINESS.......................... 50

4.1 Organization and Good Standing............................................................. 50

4.2 Authorization of Agreement .................................................................... 50

4.3 Capitalization........................................................................................... 51

4.4 Subsidiaries.............................................................................................. 51

4.5 Conflicts and Consents ............................................................................ 51

4.6 Financial Statements................................................................................ 52

4.7 Undisclosed Liabilities............................................................................. 53

4.8 Absence of Certain Developments........................................................... 53

4.9 Taxes........................................................................................................ 53

4.10 Real Property ........................................................................................... 55

4.11 Title to Purchased Assets......................................................................... 56

4.12 Intellectual Property Rights ..................................................................... 56

4.13 Material Contracts.................................................................................... 57

4.14 Employee Benefits Plans ......................................................................... 58

4.15 Labor........................................................................................................ 61

TABLE OF CONTENTS

(continued)

Page

4.16 Litigation.................................................................................................. 61

4.17 Compliance with Laws; Permits.............................................................. 61

4.18 Sufficiency of Assets ............................................................................... 66

4.19 Insurance.................................................................................................. 66

4.20 No Other Representations or Warranties; Schedules............................... 66

ARTICLE V REPRESENTATIONS AND WARRANTIES REGARDING

THE SELLER.................................................................................... 67

5.1 Organization and Good Standing............................................................. 67

5.2 Authorization of Agreement .................................................................... 67

5.3 Ownership of the Interests....................................................................... 67

5.4 Conflicts and Consents ............................................................................ 67

5.5 Litigation.................................................................................................. 68

5.6 Financial Advisors................................................................................... 68

ARTICLE VI REPRESENTATIONS AND WARRANTIES OF THE

PURCHASER.................................................................................... 68

6.1 Organization and Good Standing............................................................. 68

6.2 Authorization of Agreement .................................................................... 68

6.3 Conflicts and Consents ............................................................................ 69

6.4 Litigation.................................................................................................. 69

6.5 Investment Intention ................................................................................ 69

6.6 Financial Advisors................................................................................... 70

6.7 Guarantees................................................................................................ 70

6.8 Arrangement with Portfolio Managers .................................................... 70

6.9 Acknowledgement ................................................................................... 70

ARTICLE VII COVENANTS ................................................................................... 71

7.1 Access to Information.............................................................................. 71

7.2 Conduct of the Business Pending the Closing......................................... 72

7.3 Preservation of Back Office Support....................................................... 74

7.4 Consents................................................................................................... 74

7.5 Regulatory Approvals.............................................................................. 75

7.6 Further Assurances; Etc........................................................................... 76

7.7 Preservation of Records........................................................................... 77

7.8 Publicity................................................................................................... 77

7.9 Employee Benefits................................................................................... 77

7.10 Tax Matters.............................................................................................. 81

7.11 [Reserved]................................................................................................ 84

7.12 Client Brokerage Consents ...................................................................... 84

7.13 Client Investment Advisory Consents ..................................................... 85

7.14 Public Fund Investment Advisory Consents............................................ 86

7.15 Section 15 of the Investment Company Act............................................ 87

TABLE OF CONTENTS

(continued)

Page

7.16 Administration ......................................................................................... 88

7.17 Qualification of the Public Funds............................................................ 88

7.18 [Reserved]................................................................................................ 89

7.19 Real Property Leases................................................................................ 89

7.20 Competing Transaction............................................................................ 90

7.21 [Reserved]................................................................................................ 90

7.22 Deferred Transfers ................................................................................... 90

7.23 Right to Exclude, Delay, Etc.................................................................... 92

7.24 Trust Companies...................................................................................... 92

7.25 Bankruptcy Pleadings .............................................................................. 92

7.26 Withdrawal of Seller Capital ................................................................... 94

7.27 Lehman Commitments to Funds.............................................................. 94

7.28 Director Resignations............................................................................... 95

7.29 Taxing Authority Notification ................................................................. 95

7.30 Employee Securities Company................................................................ 95

7.31 Artwork.................................................................................................... 96

7.32 Transition Services Obligations............................................................... 96

ARTICLE VIII CONDITIONS TO CLOSING .......................................................... 98

8.1 Conditions Precedent to Obligation of the Purchaser.............................. 98

8.2 Conditions Precedent to Obligation of the Seller .................................. 100

8.3 Frustration of Closing Conditions.......................................................... 101

ARTICLE IX INDEMNIFICATION...................................................................... 101

9.1 Survival of Representations and Warranties.......................................... 101

9.2 Indemnification by the Seller................................................................. 101

9.3 Indemnification by the Purchaser .......................................................... 101

9.4 Certain Limitations on Indemnification................................................. 101

9.5 Tax Treatment of Indemnity Payments.................................................. 102

9.6 Survival of Indemnification................................................................... 102

ARTICLE X MISCELLANEOUS ........................................................................ 102

10.1 Payment of Sales, Use or Similar Taxes................................................ 102

10.2 Expenses ................................................................................................ 102

10.3 Entire Agreement; Amendments and Waivers ...................................... 102

10.4 Notices ................................................................................................... 103

10.5 Binding Effect; No Third-Party Beneficiaries; Assignment.................. 104

10.6 Enforcement........................................................................................... 104

10.7 Counterparts........................................................................................... 105

10.8 GOVERNING LAW; SUBMISSION TO JURISDICTION;

CONSENT TO SERVICE OF PROCESS; WAIVER OF JURY

TRIAL.................................................................................................... 105

10.9 Treatment as Administrative Expenses.................................................. 106

TABLE OF CONTENTS

(continued)

Page

Exhibit A Form of Bid Procedures Order

Exhibit B Form of Sale Order

NY2:\1923025\03\157TD03!.DOC\73683.1037 1

AMENDED AND RESTATED PURCHASE AGREEMENT

This Amended and Restated Purchase Agreement (this “Agreement”), is

made and entered into as of October 3, 2008, by and between IMD Parent LLC, a

Delaware limited liability company (the “Purchaser

”), Lehman Brothers Holdings Inc., a

Delaware corporation (“Parent

”), and the entities listed on Schedule I (such entities,

together with Parent, individually and collectively, the “Seller”).

W I T N E S S E T H:

WHEREAS, Parent is a debtor-in-possession under title 11 of the United

States Code, 11 U.S.C. § 101 et seq. (the “Bankruptcy Code

”), and filed a voluntary

petition for relief under chapter 11 of the Bankruptcy Code on September 15, 2008 in the

United States Bankruptcy Court for the Southern District of New York;

WHEREAS, the Seller and its Subsidiaries presently conduct the

Business;

WHEREAS, the Seller desires to sell, transfer and assign to the Purchaser,

and the Purchaser desires to purchase, acquire and assume from the Seller, pursuant to

Sections 363 and 365 of the Bankruptcy Code and otherwise, all of the Purchased Assets

and Assumed Liabilities free and clear of any and all Claims and Liens, all as more

specifically provided herein; and

WHEREAS, the Seller and the Purchaser entered into the Purchase

Agreement dated as of September 29, 2008 (the “Original Purchase Agreement

”) and

now wish to amend and restate the Original Purchase Agreement in its entirety as set

forth herein, with effect from the execution and delivery of the Original Purchase

Agreement on September 29, 2008 (the “Execution Date”).

NOW, THEREFORE, in consideration of the premises and the mutual

covenants and agreements hereinafter contained, the parties hereby agree as follows:

ARTICLE I

DEFINITIONS

1.1 Certain Definitions

.

(a) For purposes of this Agreement, the following terms shall have the

meanings specified in this Section 1.1:

“Acquired Subsidiary” means any member of the Company Group, the

equity interests of which are purchased directly or indirectly by the Purchaser hereunder.

“Acquired Subsidiary Tax Proceeding” has the meaning set forth in

Section 7.10(d)

.

2

“Active” means, as of a specified time, with respect to a Person employed

in the NB Business as a member of a Team as of the Execution Date, that, as of the

specified time, such Person (i) has entered into a definitive employment agreement in

form and substance satisfactory to the Purchaser with respect to such Person's continued

employment in the Business after the Closing and (ii) has not retired, resigned, become

disabled, died or otherwise ceased to perform services for such Team in a manner

consistent with such Person’s employment agreement. For the avoidance of doubt, term

sheets and similar documentation shall not be treated as definitive employment

agreements for purposes of this definition.

“Actual EBITDA” means the product of (i) 2 times (ii) EBITDA for the

two fiscal quarters ended May 31, 2008, as calculated from the Audited Financial

Statements; provided for purposes of such calculation, (A) compensation expense shall be

deemed to include all compensation, whether paid in cash or deferred, as if such

compensation was paid in full in cash ratably over the fiscal year for which such

compensation was awarded and (B) the methodology for allocating dedicated costs to the

Business (including the percentage allocation to the NB Business) shall be the same as

was used in preparing the NB Business Financial Information.

“Administered Assets” has the meaning set forth in Section 7.16.

“Administrator” has the meaning set forth in Section 7.16.

“Advisory Contract” has the meaning set forth in Section 4.13(c).

“Affiliate” means, with respect to any Person, any other Person that,

directly or indirectly through one or more intermediaries, controls, or is controlled by, or

is under common control with, such Person, and the term “control” (including the terms

“controlled by” and “under common control with”) means the possession, directly or

indirectly, of the power to direct or cause the direction of the management and policies of

such Person, whether through ownership of voting securities, by contract or otherwise.

Notwithstanding the foregoing definition of “Affiliate,” no Fund shall be deemed an

Affiliate of Seller or Parent for purposes of this Agreement, neither of the Trust

Companies shall be deemed an Affiliate of Seller or Parent for purposes of this

Agreement and no portfolio company of any direct or indirect equity holder of the

Purchaser shall be deemed an Affiliate of Purchaser or any of its Subsidiaries.

“Aggregate Fixed Income Revenue Run-Rate” means the aggregate Fixed

Income Revenue Run-Rate, calculated as of the close of business in New York on a given

measurement date, of all Clients of the Fixed Income Business that are Consenting Fixed

Income Clients as of such date.

“Agreement

” has the meaning set forth in the preamble.

“Allocation

” has the meaning set forth in Section 7.10(f).

3

“Ancillary Agreements” means the Transition Services Agreements,

Subleases and any other agreement entered into on or prior to the Closing Date in

connection with the consummation of the transactions contemplated hereby (but does not

include any Retention Arrangements).

“Assumed Liabilities” has the meaning set forth in Section 2.3.

“Auction” has the meaning set forth in the Bid Procedures Order.

“Audited Financial Statements” means the final audited statement of the

special purpose combined financial position and statement of operations of the NB

Business as of and for the two fiscal-quarter period ended May 31, 2008, prepared in

accordance with GAAP on a full carve out basis with the exception that such financial

statements shall (i) be on a pre-tax income basis and will not include the current and

deferred provision for income taxes and related tax assets or liabilities, (ii) exclude any

additional push-down of fixed asset balances and depreciation and amortization, asset

impairment charges and interest income (not including the revenue associated with the

margin debits) and expense outside of amounts historically recorded within the NB

Business Financial Information and (iii) be prepared on a going-concern basis

“Balance Sheet Date” has the meaning set forth in Section 4.6(a).

“Bankruptcy Case” means any case, now or hereafter, filed under chapter

11 or 7 of the Bankruptcy Code by Seller or any Subsidiary of Parent or any case under

SIPA filed against a Subsidiary of Parent.

“Bankruptcy Code” has the meaning set forth in the recitals.

“Bankruptcy Court” means the United States Bankruptcy Court for the

Southern District of New York or such other court as has jurisdiction over a Bankruptcy

Case.

“Bankruptcy Rules

” means the United States Federal Rules of Bankruptcy

Procedure and any local rules of the Bankruptcy Court.

“BarCap

” means Barclays Capital Inc.

“BarCap APA” has the meaning set forth in the definition of “Excluded

Assets”.

“BarCap TSA

” has the meaning set forth in the definition of “Purchased

Assets”.

“Base Aggregate Fixed Income Revenue Run-Rate” means

$129,000,000.00, as presented on Schedule 1.1(a)

, which constitutes the aggregate Fixed

Income Revenue Run-Rate of all Clients, calculated as of the close of business in New

York on the Base Date.

4

“Base Aggregate NB Revenue Run-Rate” means, with respect to any

Team, the amount set forth opposite such Team’s name under the column Captioned

“Run Rate Revenues ($ Millions)” on the Team Run Rate Schedule.

“Base Date

” means September 19, 2008, except (a) with respect to the

WRAP products set forth on Schedules 1.1(a)

and 1.1(b), the “Base Date” means August

31, 2008 and (b) with respect to those segments set forth under “Institutional FI

Management” on Schedule 1.1(a), the “Base Date” means September 18, 2008.

“Base Purchase Price” has the meaning set forth in Section 2.8.

“Bid Procedures Order

” means an Order of the Bankruptcy Court,

substantially in the form attached hereto as Exhibit A

, approving the Bidding Procedures.

“Bidding Procedures” has the meaning ascribed to it in the Bid Procedures

Order.

“Broker-Dealer Subsidiaries” has the meaning set forth in Section 4.17(f).

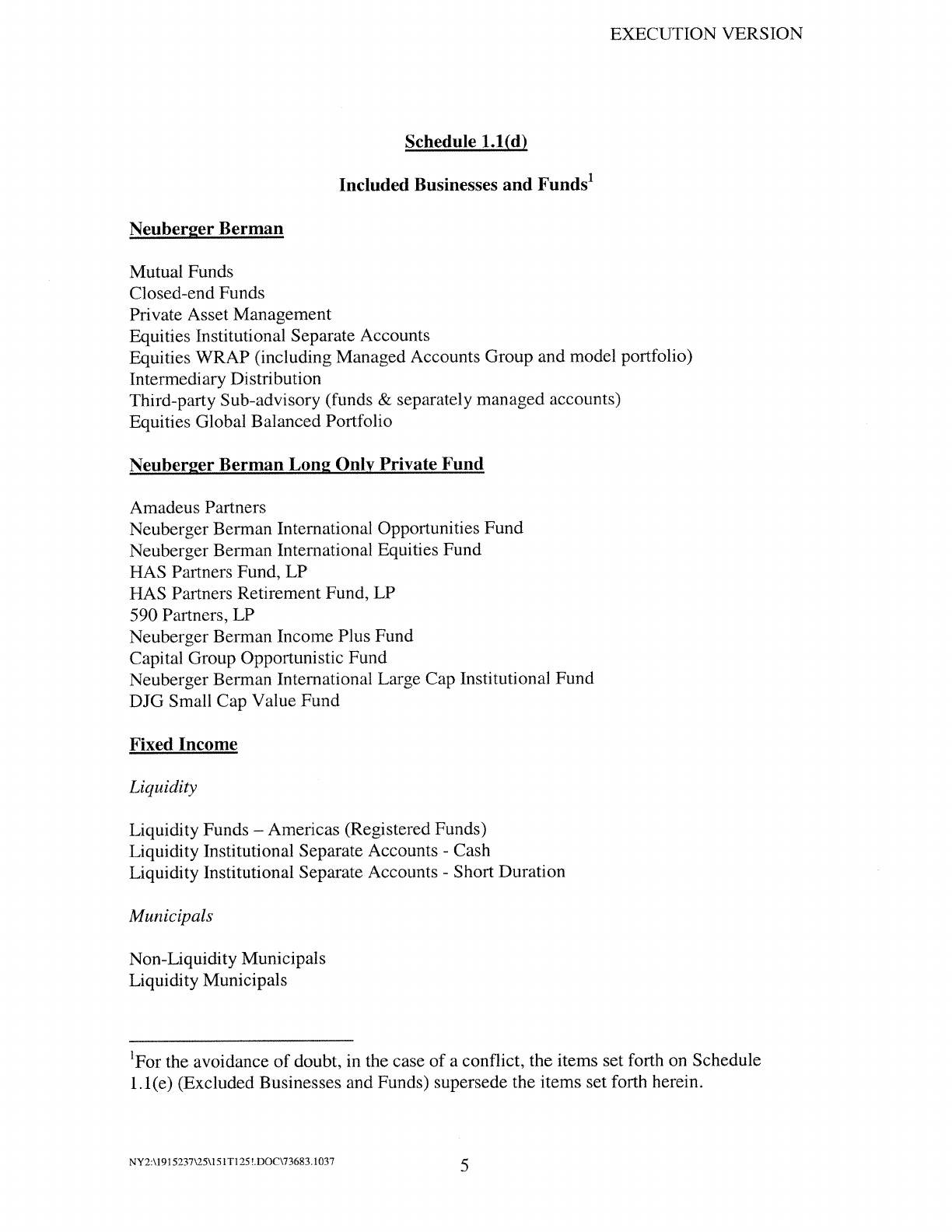

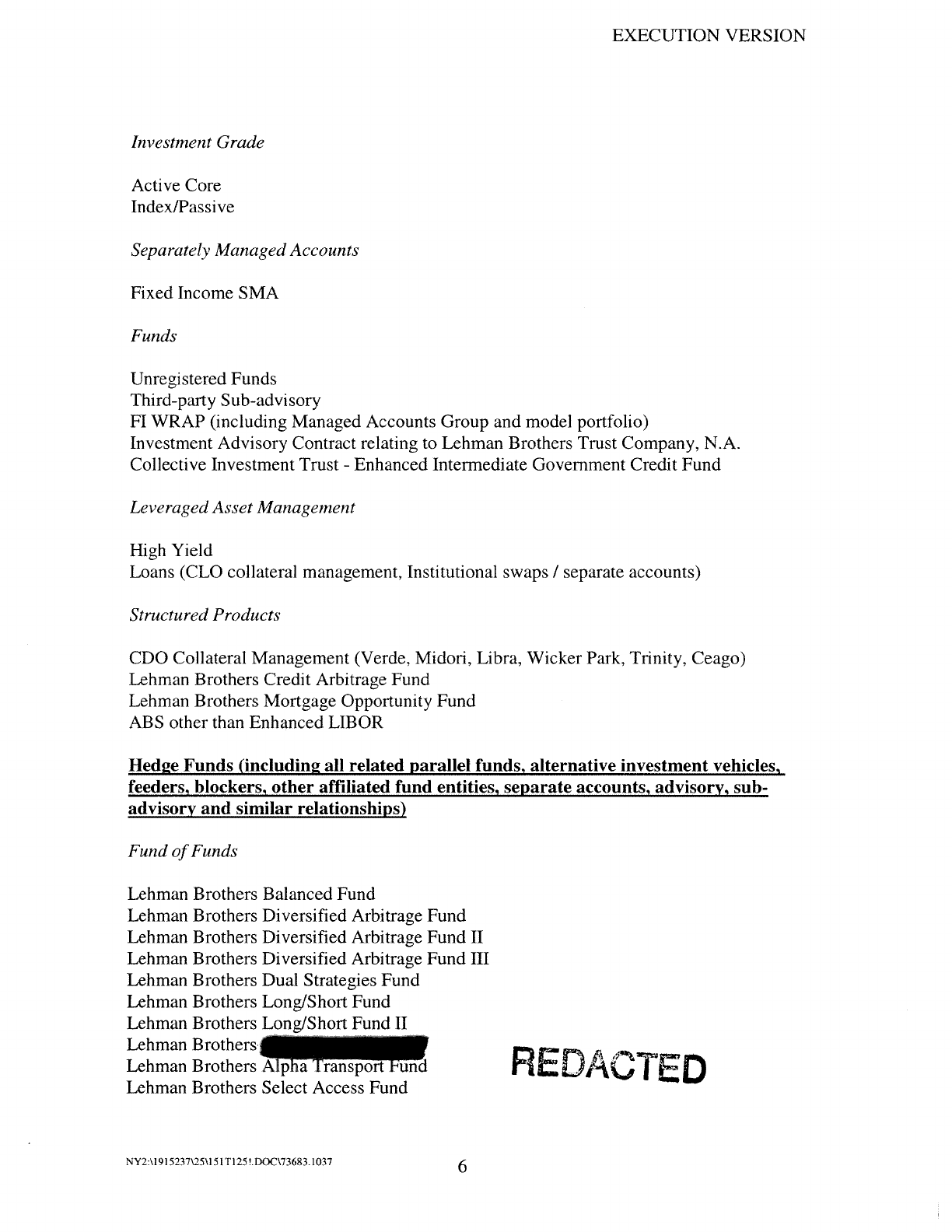

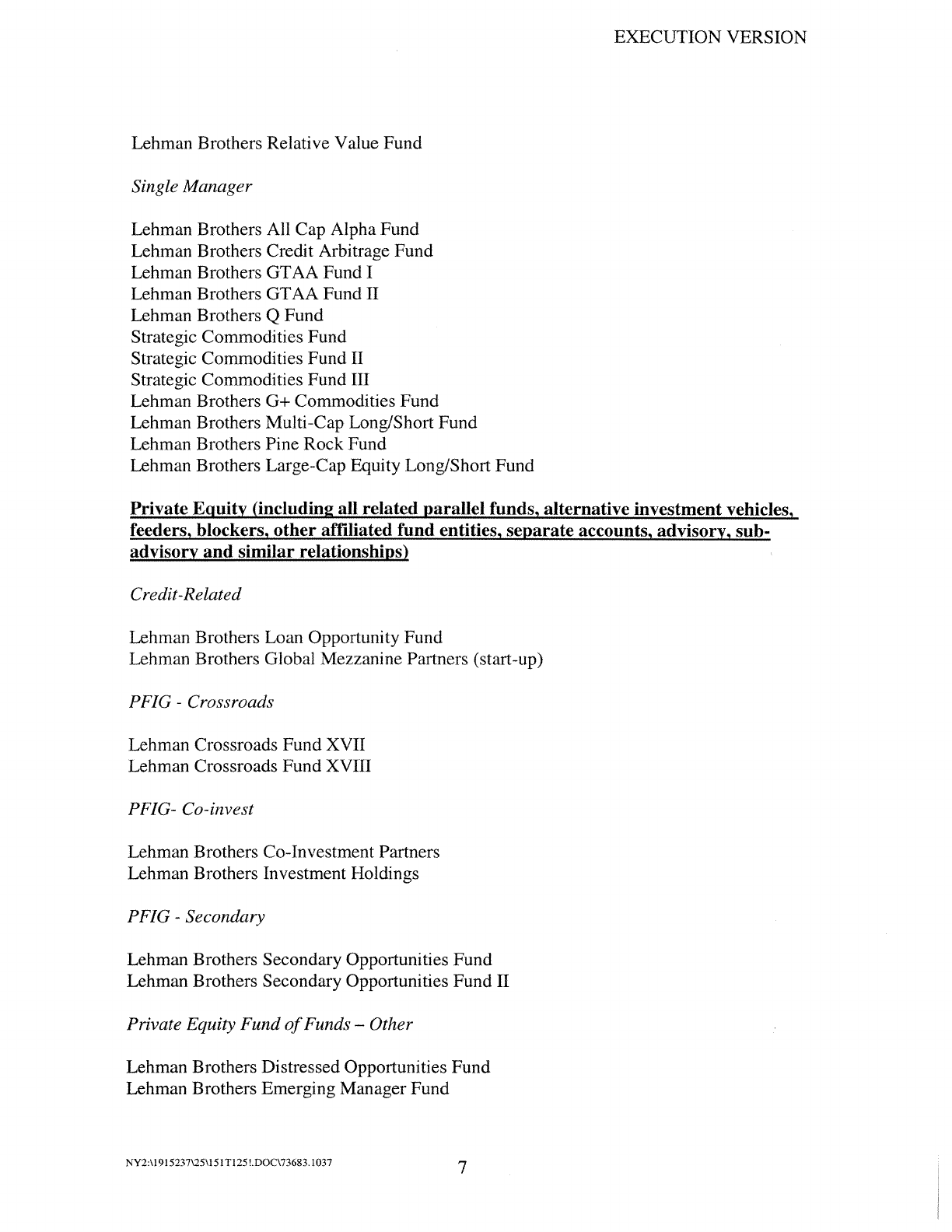

“Business” means the investment management business conducted by the

Seller and its Affiliates, which for purposes of this Agreement includes the businesses

and the Funds set forth on Schedule 1.1(d) but excludes the businesses and the Funds set

forth on Schedule 1.1(e), and which, during the periods covered by the Financial

Statements, generated the revenues and earnings reflected therein, and which, for

avoidance of doubt, includes the business of providing asset management, investment

advisory services and, where applicable, brokerage and distribution services, to the

Clients reflected on the Excel file provided prior to the Execution Date by Parent to

Purchaser in the calculation of the Total Base Aggregate NB Revenue Run-Rate, the

Clients reflected on the Excel file previously provided by Parent to Purchaser in the

calculation of the Base Aggregate Fixed Income Revenue Run-Rate and the Clients of the

other businesses and Funds set forth in Schedule 1.1(d), but excludes any portions of that

business represented by the Excluded Assets and the Excluded Liabilities.

“Business Day” means any day of the year on which national banking

institutions in the City of New York are open to the public for conducting business and

are not required or authorized to close.

“Cash

” means the amount of cash, bank deposits and cash equivalents, as

reflected in bank or brokerage statements, less, to the extent included therein, deposits,

escrowed funds, prepaid charges and expenses or other restricted cash balances, and less

the amounts of any unpaid checks, drafts and wire transfers issued on or prior to the date

of determination.

“Claims” has the meaning set forth in Section 101(5) of the Bankruptcy

Code.

5

“Client” means any Fund or other Person to which any member of the

Company Group, directly or indirectly, provides investment advisory services pursuant to

an investment advisory Contract.

“Closing

” has the meaning set forth in Section 3.1.

“Closing Cash

” has the meaning set forth in Section 2.11(a).

“Closing Cash Target” means $203,000,000, plus (a) the aggregate

amount of the following Liabilities, determined immediately prior to the Closing Date: (i)

with respect to any services rendered by Transferred Employees in any period ending on

or before the Closing Date, all Liabilities for (A) accrued but unpaid salary and all other

compensation-related Liabilities to Transferred Employees, to the extent required to be

paid by Purchaser or its Subsidiaries in accordance with Section 7.9(b), determined

(except with respect to compensation described in clause (i)(B) of this definition) in

accordance with GAAP, and (B) the aggregate amount of the incentive compensation and

bonuses, to the extent required to be paid by Purchaser or its Subsidiaries to Transferred

Employees and accrued, in each case, pursuant to Section 7.9(c) that have not been paid

prior to the Closing, the amount of which shall be determined in accordance with Section

7.9(c); (ii) Taxes of any Acquired Subsidiary for any pre-Closing period, including any

Pre-Closing Straddle Period, and any other Taxes in respect of the Purchased Assets for

which the Purchaser or any Subsidiary of the Purchaser may be liable after the Closing,

determined in accordance with GAAP (excluding for this purpose deferred Taxes); (iii)

all Liabilities of any member of the Company Group to Parent, the Seller or any of their

respective Affiliates (other than members of the Company Group) that are not discharged

on or prior to the Closing Date; (iv) $92,000,000, which represents an agreed estimated

present value of the earn-out Liabilities set forth on Schedule 1.1(f) (to the extent that

amount has not come due in accordance with its terms without any acceleration of any

portion thereof and has not been paid on or prior to Closing); and (v) all accounts

payable, including payables to brokers, dealers and clients, and all accrued expenses, of

the Business, determined in accordance with GAAP plus (b) the pro-rated portion of any

Management Fees, carried-interest, incentive fees and other fees based on assets under

management or investment performance, in each case, paid on or before Closing that

have yet to be earned as of the Closing Date, and minus

(c) the pro-rated portion of any

Management Fees that have been earned but not paid in cash as of the Closing Date that

are receivable from Persons other than the Debtors, any other Person subject to

insolvency or bankruptcy or any of their respective Affiliates, plus (d) the product of (I)

$400,000,000 times (II) a fraction, the numerator of which shall be the Base Purchase

Price, less the Estimated Aggregate Additional Adjustment or the Final Aggregate

Additional Adjustment, as the case may be, plus

the Closing Other Liabilities Adjustment

and the denominator of which shall be the Base Purchase Price. Notwithstanding

anything to the contrary in clause (ii) of this definition of “Closing Cash Target”,

Liabilities of any Acquired Subsidiary, or in respect of any Purchased Asset, arising

pursuant to Treasury Regulation Section 1.1502-6 (or any predecessor or successor

thereof or any analogous or similar provision under state, local or foreign Tax Law) shall

6

only be taken into account to the extent such Liabilities have become fixed and

determinable as of the time when Closing Cash Target is determined.

“Closing Date” has the meaning set forth in Section 3.1.

“Closing Other Liabilities Adjustment

” means all Liabilities based on

facts and circumstances first arising before the Closing (other than (i) Liabilities with

respect to Taxes and (ii) Liabilities of any Acquired Subsidiary to the extent Purchaser

would not have been liable for such Liabilities had Purchaser purchased such Acquired

Subsidiary’s assets instead of equity interests in such Acquired Subsidiary) of the

Business or any Seller or any of its Affiliates (a) for which the Purchaser or any of its

Subsidiaries may be liable after the Closing and (b) that are not included in the

calculation of the Closing Cash Target.

“Closing S&P Adjustment

” means (a) if the S&P Percentage is less than

or equal to zero, zero and, (b) if the S&P Percentage is greater than zero, a dollar amount

equal to the (i) product of 0.5 times the S&P Percentage of the Total Base Aggregate NB

Revenue Run-Rate multiplied by (ii) 7.5.

“Closing Schedule” has the meaning set forth in Section 2.11(a).

“Closing Schedule Calculation” has the meaning set forth in

Section 2.11(b).

“Co-Invest Fund” has the meaning set forth in Section 7.30.

“Code” means the Internal Revenue Code of 1986, as amended.

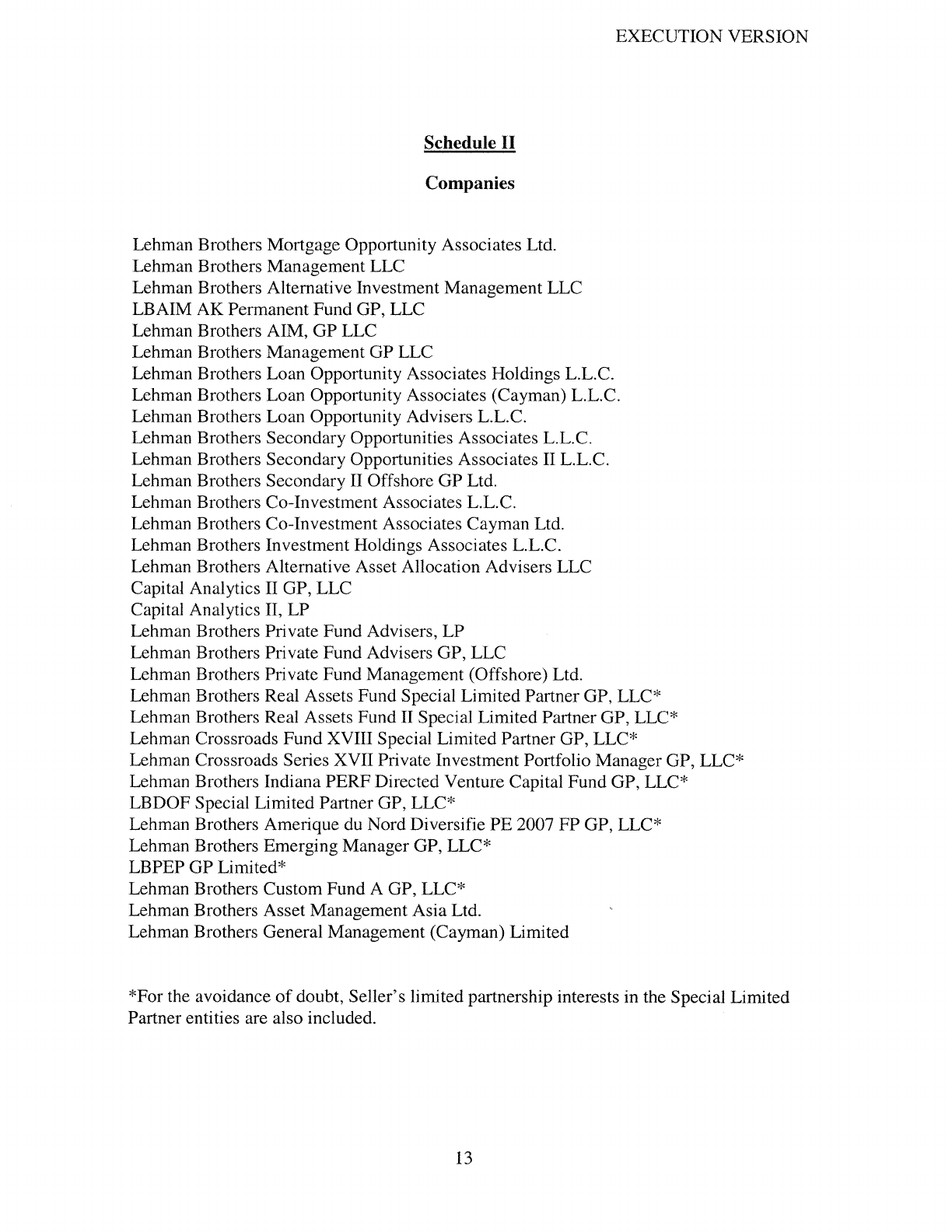

“Companies” means, collectively, the entities listed on Schedule II.

“Company Benefit Plan

” has the meaning set forth in Section 4.14(a).

“Company Documents

” has the meaning set forth in Section 4.2.

“Company Group

” means, collectively, the Companies and their direct

and indirect Subsidiaries.

“Company Plans” has the meaning set forth in Section 7.9(a).

“Competing Transaction

” is defined in Section 7.20(a).

“Confidentiality Agreements” means (a) the confidentiality agreement,

dated as of July 28, 2008, by and between Hellman & Friedman Advisors LLC and

Parent and (b) the confidentiality agreement, dated as of July 30, 2008, by and between

Bain Capital Partners, LLC and Parent.

“Consenting Fixed Income Client” means, as of any date:

7

(a) with respect to Clients of the Fixed Income Business that are not

Funds, any Client that as of such date has provided written consent, or is deemed to have

provided so-called implied or negative consent in accordance with Section 7.13 (or that is

not required under applicable law or the applicable investment advisory agreement to

consent), to the assignment or deemed assignment of its investment advisory agreement

as a result of the transactions contemplated by this Agreement;

(b) with respect to Clients of the Fixed Income Business that are

Public Funds, any Public Fund that as of such date (i) has entered into a New Public Fund

Investment Advisory Agreement and Other Public Funds Agreements in accordance with

Section 7.14(a) and (ii) has obtained the shareholder approvals specified in

Section 7.14(b); and

(c) with respect to Clients of the Fixed Income Business that are

Private Funds, any Private Fund whose investors (or the relevant person or group duly

authorized to act on behalf of investors in the relevant capacity) have given the written

consent to such matters related to the transactions contemplated by this Agreement as the

Purchaser requests in order to approve and make effective such matters under the

applicable provisions of the fund documents for such Private Fund.

“Consenting NB Client” means, as of any date:

(a) with respect to Clients of the NB Business that are not Funds, any

Client that as of such date has provided written consent, or is deemed to have provided

so-called implied or negative consent in accordance with Section 7.13 (or that is not

required under applicable Law or the applicable investment advisory agreement to

consent), to the assignment or deemed assignment of its investment advisory agreement

as a result of the transactions contemplated by this Agreement;

(b) with respect to Clients of the NB Business that are Public Funds,

any Public Fund that as of such date (i) has entered into a New Public Fund Investment

Advisory Agreement and Other Public Funds Agreements in accordance with

Section 7.14(a) and (ii) has obtained the shareholder approvals specified in

Section 7.14(b);

and

(c) with respect to Clients of the NB Business that are Private Funds,

any Private Fund whose investors (or the relevant person or group duly authorized to act

on behalf of investors in the relevant capacity) have given the written consent to such

matters related to the transactions contemplated by this Agreement as the Purchaser

requests in order to approve and make effective such matters under the applicable

provisions of the fund documents for such Private Fund.

“Contract” means any contract, agreement, release, consent, covenant,

indenture, bond, mortgage, loan, lease or license.

“Cure Amounts

” has the meaning set forth in Section 2.5(c).

8

“Debtors” means Parent and any Subsidiary of Parent or any member of

the Company Group that is the subject of a proceeding under chapter 11 or chapter 7 of

the Bankruptcy Code or under SIPA at any time prior to the Closing Date.

“Deferred Transfer Purchased Asset

” has the meaning set forth in

Section 7.22(a)

.

“Deferred Transfer Assumed Liability” has the meaning set forth in

Section 7.22(b).

“Departure Percentage” means (i) the Departure Percentage Aggregate NB

Revenue Run-Rate, divided by

(ii) the Total Base Aggregate NB Revenue Run-Rate,

expressed as a percentage.

“Departure Percentage Aggregate NB Revenue Run-Rate

” means the sum

of (a) the Base Aggregate NB Revenue Run-Rate of all Clients of Teams for which all

Key Persons or all Principal Persons are Active as of the Closing Date, plus (b) 50% of

the Base Aggregate NB Revenue Run-Rate of all Clients of Teams for which one and

only one Principal Person is Active as of the Closing Date, plus (c) the Base Aggregate

NB Revenue Run-Rate of all Clients that are not Clients of any Team.

“Designation Notice” means a notice delivered by the Purchaser, in its

sole and absolute discretion, to the Seller designating any Seller or any member of the

Company Group as an entity that will sell, assign, convey and deliver to the Purchaser the

Purchased Assets, free and clear of all Liens and Claims pursuant to sections 363 and 365

of the Bankruptcy Code in a voluntary proceeding under the Bankruptcy Code in

connection with the transactions contemplated herein, which notice shall be delivered to

Parent no earlier than forty-five (45) days after the Execution Date and no later than sixty

(60) days after the Execution Date.

“Documents

” means all files, documents, instruments, papers, books,

reports, records, tapes, microfilms, photographs, letters, budgets, forecasts, ledgers,

journals, title policies, customer lists, regulatory filings, operating data and plans,

technical documentation (design specifications, functional requirements, operating

instructions, logic manuals, flow charts, etc.), user documentation (installation guides,

user manuals, training materials, release notes, working papers, etc.), marketing

documentation (sales brochures, flyers, pamphlets, web pages, etc.), and other similar

material related to or necessary for the conduct of the Business and the Purchased Assets

in each case whether or not in electronic form.

“EBITDA” means, with respect to any specified fiscal period, the

combined net income of the NB Business, (a) increased by the following (in each case to

the extent deducted in determining combined net income): (i) combined income tax

expense, (ii) combined interest expense and (iii) combined depreciation and amortization

expense; and (b) excluding the following (in each case to the extent included in

determining combined net income): (i) interest income (not including the revenue

9

associated with referral fees associated with margin debits that are recorded as interest

income), (ii) carried-interest, profit-sharing and other performance-based income, (iii) the

impact of any mark-to-market of investments, (iv) extraordinary or non-recurring revenue

items, (v) costs and expenses that have historically been treated as shared costs (but not

costs and expenses that have historically been treated as direct charge or dedicated

allocations) allocated from Parent and its Affiliates, to the NB Business and other

members of the Company Group involved in the conduct of the NB Business (the

“Shared LEH Allocations” as referenced in Schedule 4.6) and (vii) the Historic

Adjustments as set forth on Schedule 1.1(i)

.

“EBITDA Adjustment

” means:

(a) if Target EBITDA is equal to or less than Actual EBITDA, $0; or

(b) if Target EBITDA exceeds Actual EBITDA and clause (c) is not

applicable, a dollar amount equal to the product of (i) the amount by which Target

EBITDA exceeds Actual EBITDA multiplied by (ii) 7.5; or

(c) if Parent validly elected in accordance with this Agreement to

cause the Estimated EBITDA Adjustment to equal $190,000,000, $190,000,000.

“ERISA” has the meaning set forth in Section 4.14(a).

“ERISA Affiliate” has the meaning set forth in Section 4.14(d).

“Estimated Aggregate Additional Adjustment” means (a) the sum of (i)

the Estimated Closing NB Adjustment plus (ii) the Estimated EBITDA Adjustment plus

(iii) the Estimated Other Liabilities Adjustment plus (iv) the Estimated Closing S&P

Adjustment; or (b) at the election of Parent (which shall be delivered in writing to

Purchaser no later than five Business Days prior to Closing Date), $850,000,000.

“Estimated Closing Cash

” has the meaning set forth in Section 2.10(a).

“Estimated Closing Cash Excess” means the positive amount, if any, by

which Estimated Closing Cash is more than the Estimated Closing Cash Target.

“Estimated Closing Cash Shortfall

” means the positive amount, if any, by

which the Estimated Closing Cash Target exceeds Estimated Closing Cash.

“Estimated Closing Cash Target

” has the meaning set forth in

Section 2.10(a).

“Estimated Closing NB Adjustment” means:

(a) if the Preliminary Closing NB Revenue Run-Rate Percentage

equals or exceeds 100%, then $0;

10

(b) if the Preliminary Closing NB Revenue Run-Rate Percentage is

less than 100%, but greater than or equal to 70%, a dollar amount equal to the product of

(i) 0.5 multiplied by (ii) the difference between (A) the Total Base Aggregate NB

Revenue Run-Rate, minus

(B) the Preliminary Closing Aggregate NB Revenue Run-Rate,

multiplied by

(iii) 7.5; or

(c) if the Preliminary Closing NB Revenue Run-Rate Percentage is

less than 70%, a dollar amount equal to the product of (i) 0.5 multiplied by (ii) 30% of the

Total Base Aggregate NB Revenue Run-Rate, multiplied by (iii) 7.5.

“Estimated Closing S&P Adjustment

” has the meaning set forth in

Section 2.10(a)

.

“Estimated EBITDA Adjustment” has the meaning set forth in

Section 2.10(a).

“Estimated Other Liabilities Adjustment” has the meaning set forth in

Section 2.10(a).

“Exchange Act” means the Securities Exchange Act of 1934 and the rules

and regulations promulgated thereunder, as amended from time to time.

“Excluded Assets” shall mean the following assets, properties, interests

and rights of Seller and its Subsidiaries (other than the Acquired Subsidiaries, except with

respect to clause (r) of this definition of “Excluded Assets”):

(a) the assets primarily associated with the ICG business of Parent and

its Affiliates (which provides equities and fixed income capital markets execution

services to midsized institutional clients);

(b) the assets primarily associated with the CTS business of Parent and

its Affiliates (which provides cash management services to primarily corporate clients

and some high net worth clients);

(c) the assets primarily associated with the Satori business of Parent

and its Affiliates (which provides investment advisory services to private investment

partnerships and managed accounts);

(d) the assets primarily associated with the LibertyView business of

Parent and its Affiliates (which provides investment advisory services to private

investment partnerships that use the LibertyView brand name);

(e) the assets that were sold to BarCap pursuant to that certain Asset

Purchase Agreement among Parent, Lehman Brothers Inc., LB 745 LLC and BarCap,

dated as of September 16, 2008 (as amended or modified prior to the Execution Date, the

“BarCap APA”), including the assets described in the BarCap APA relating to the Private

Investment Management business of Parent and its Affiliates (which provides traditional

11

brokerage and comprehensive investment, wealth advisory, trust and capital markets

execution services to high net worth individuals and institutional clients);

(f) the equity interests in, and business conducted by, the Trust

Companies; but for the avoidance of doubt, this exclusion shall not apply to Purchased

Contracts pursuant to which the Business provides advisory or sub-advisory services to

the Trust Companies or clients of the Trust Companies;

(g) the assets primarily associated with the private equity business of

Parent and its Affiliates other than the assets associated with the Funds and related

entities set forth on Schedule 1.1(j)

(the “Acquired Private Equity Business”);

(h) the assets primarily associated with the asset management business

of Parent and its Affiliates located in Europe and Asia other than the assets of the

business segments set forth on Schedule 1.1(k)

;

(i) [Reserved];

(j) the Hedge Fund Minority Stake Investments;

(k) the funded amount of Parent’s and/or its Affiliates’ limited partner

and side-by-side capital commitments to the Funds (which for the avoidance of doubt,

does not include funded commitments in respect of special limited partnership interests

and general partnership interests);

(l) seed capital invested in the Business’ asset management products

(which shall be returned to Seller pursuant to the terms of the relevant fund documents

but subject to the withdrawal limitations as set forth in Section 7.26);

(m) any investment by Parent or any of its Affiliates as principal in,

and the funded amount of Parent’s and or its Affiliates capital commitments as principal

to, any third-party managed funds;

(n) the shares of capital stock, limited liability company membership,

general and limited partnership, and other equity interests, of Seller and its Subsidiaries

(other than the shares of capital stock, limited liability company membership, general and

limited partnership, and other equity interests that are treated as Purchased Assets by

reason of clauses (l) and (n) of the definition thereof);

(o) the Excluded Contracts and any accounts receivable to the extent

arising out of any Excluded Contract;

(p) any Intellectual Property Rights that do not constitute Purchased

Intellectual Property;

(q) any (i) confidential personnel and medical records pertaining to

any Excluded Employee; (ii) other books and records that Seller is required by Law to

12

retain or that Parent reasonably determines are necessary to retain including, without

limitation, Tax Returns, financial statements, and corporate or other entity filings;

provided, however, that Purchaser shall have the right to make copies of any portions of

such retained books and records that relate to the Business or any of the Purchased

Assets; and (iii) minute books, stock ledgers and stock certificates of Subsidiaries of the

Seller the equity interests of which are not included in the Purchased Assets;

(r) any claim, right or interest of Parent or any of its Subsidiaries

(including any of the Acquired Subsidiaries) in or to any refund, rebate, abatement, credit

or other recovery for Taxes, together with any interest due thereon or penalty rebate

arising therefrom, for any Tax period (or portion thereof) ending on or before the Closing

Date, other than any such refund, rebate, credit or other recovery arising from or

attributable to the carryback of a loss or credit from a period ending after the Closing

Date; provided, however, if it is possible under applicable law to carry back both (i) a

loss or credit of an Acquired Subsidiary or the Purchaser or any Subsidiary of the

Purchaser for a period ending after the Closing Date (a “Purchaser Loss”) and (ii) any

other loss or credit (a “Seller Loss”) to the same tax period, then the Seller shall be

entitled to any refund, rebate, credit or other recovery for such period in respect of the

Seller Loss if the Seller Loss is required under such law to be utilized before the

Purchaser Loss, and the Purchaser shall be entitled to any refund, rebate, credit or other

recovery for such period in respect of the Purchaser Loss if the Purchaser Loss is

required under such law to be utilized before the Seller Loss, except in each case to the

extent such refund, rebate, credit or other recovery previously has been paid to the other

party.

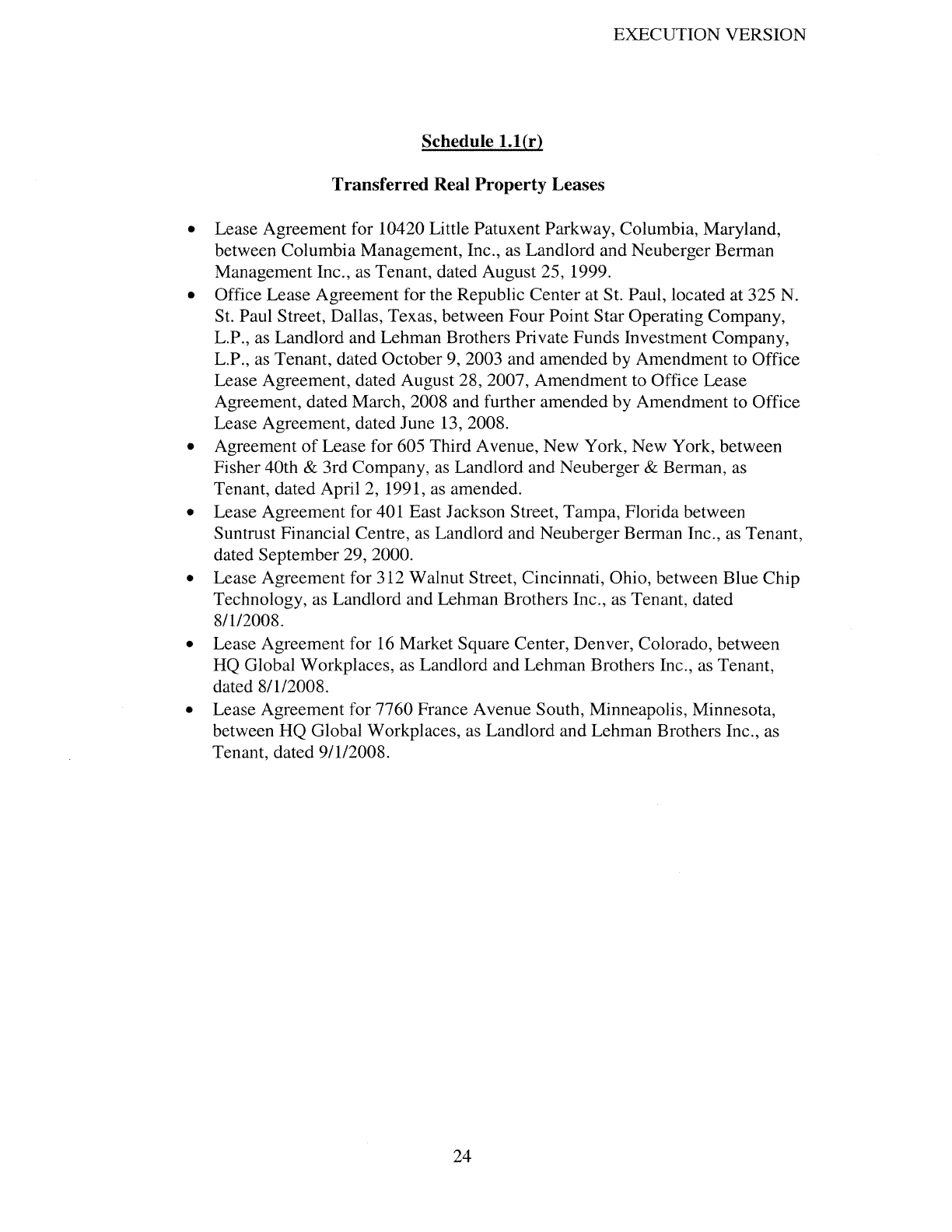

(s) all real property leases of Seller and its Subsidiaries, and all rights

and obligations appurtenant thereto, other than the Transferred Real Property Leases;

(t) if so elected by the Purchaser in its sole and absolute discretion at

any time prior to the Closing Date, any or all of the equity interests in, or assets of, any

member of the Company Group that is the general partner or managing member of, or the

management company or investment advisor to, any Private Fund whose investors have

not approved and made effective (or approved to be made effective in connection with

the Closing), in accordance with the applicable provisions of the fund documents of such

Private Fund, such amendments to the fund documents of such Private Fund and such

other matters as the Purchaser may propose in connection with the Closing;

(u) any margin debit balances in respect of loans advanced by the

Seller or its Subsidiaries;

(v) any deposits or prepaid charges and expenses to the extent paid in

connection with or relating to any Excluded Assets;

(w) the assets specified on Schedule 1.1(l) as being expressly set aside,

segregated or held for the purpose of satisfying the Excluded Liabilities specified

thereon;

13

(x) any and all assets designated as Excluded Assets by the Purchaser

pursuant to Section 7.23;

(y) the assets and other properties specified on Schedule 1.1(m), which

are under the control or direction of the respective administrator, liquidator, trustee or

similar entity specified thereon;

(z) all fine art paintings and sculptures owned by any member of the

Company Group;

(aa) any assets exclusively related to Excluded Liabilities described in

Section 2.4(e), (f), (g), (h), (j) and (k); and

(bb) any rights, claims, choses in action, or other causes of action,

against any Person (other than an Acquired Subsidiary), whether or not asserted or

known, based on facts existing or events occurring in any period ending on or prior to

the Closing, to the extent such rights, claims, choses in action or other causes of action

arise from or relate to any of the foregoing or any Excluded Liabilities for which neither

the Purchaser nor any of its Subsidiaries would be liable after the Closing by operation of

law or otherwise.

“Excluded Contracts” means all Contracts, arrangements or

understandings, whether written or oral, between any member of the Company Group on

the one hand, and the Seller or any of its Affiliates, on the other hand, and all Contracts

of Seller and its Subsidiaries (other than the Acquired Subsidiaries), other than the

Purchased Contracts.

“Excluded Employee” has the meaning set forth in Section 7.9(a).

“Excluded Liabilities” has the meaning set forth in Section 2.4.

“Execution Date

” has the meaning set forth in the recitals.

“Final Aggregate Additional Adjustment” means (a) an amount equal to

the sum of (i) the Final True-Up Date NB Adjustment plus (ii) the Final EBITDA

Adjustment plus

(iii) the Final Other Liabilities Adjustment plus (iv) the Final S&P

Adjustment; or (b) if Parent validly elected in accordance with this Agreement to cause

the Estimated Aggregate Additional Adjustment to equal $850,000,000, an amount equal

to $850,000,000.

“Final Closing Cash

” has the meaning set forth in Section 2.11(e).

“Final Closing Cash Target” has the meaning set forth in Section 2.11(e).

“Final Closing S&P Adjustment

” has the meaning set forth in

Section 2.11(e)

.

14

“Final EBITDA Adjustment” has the meaning set forth in Section 2.11(e).

“Final Measurement Date NB Adjustment” has the meaning set forth in

Section 2.11(e).

“Final Order

” shall mean an Order of any court of competent jurisdiction

for which either (i) the period for the filing of a timely appeal of such Order shall have

expired and such Order is not stayed, amended or modified without the Purchaser’s prior

written consent or (ii) in the event there are any timely filed motions for a new trial, to

alter or amend the judgment or for reconsideration or any appeals, all such motions or

appeals shall have been resolved without any reversal, vacation or modification of such

Order and the period for the filing of a timely appeal of such Order shall have expired.

“Final Other Liabilities Adjustment

” has the meaning set forth in

Section 2.11(e).

“Final True-Up Date NB Adjustment” has the meaning set forth in

Section 2.11(e).

“Financial Information” has the meaning set forth in Section 4.6(a).

“Financial Statements” means the Financial Information and the NBH

Financials.

“FINRA” means the Financial Industry Regulatory Authority.

“Fixed Income Assets Under Management” means, for any Client as of the

close of business in New York on a particular measurement date, the amount, expressed

in U.S. dollars, of assets under management or assets with respect to model portfolios by

the Fixed Income Business for such Client as of the Base Date. In calculating Fixed

Income Assets Under Management for a date that is after the Base Date, the calculation

shall be:

(a) adjusted to reflect the net cash flows (i.e., additions, including, in

the case of Funds, reinvestments of distributions or dividends, and redemptions and

withdrawals, including, in the case of Funds, dividends and distributions) after the

applicable Base Date, but on or prior to the measurement date with respect to the

accounts of such Clients from and after the Base Date;

(b) reduced for accounts that, after the Base Date and on or prior to the

measurement date, are terminated or with respect to which notices of termination or

indications of an intention to terminate are received and not revoked;

(c) not adjusted for any increase or decrease in the amount of assets

under management for any Client accounts due to market appreciation or depreciation or

changes in foreign exchange rates, in each case, from and after the Base Date; and

15

(d) not adjusted for any increase or, with respect to the assets

identified on Schedule 1.1(n), decrease after the Base Date in the amount of assets

invested in any Fund by Parent or any of its controlled Affiliates acting as principal on its

own behalf or in a fiduciary capacity on behalf of Clients where Parent or such controlled

Affiliate has investment discretion.

For purposes of this definition: (i) any assets under management for any

account for which the Seller or members of the Company Group act as investment

adviser and sub-adviser will be counted only once; (ii) any assets under management for

any set of accounts, one of which invests in the other will be counted only once if

members of the Company Group or the Seller act as investment adviser to both; (iii)

withdrawals and redemptions, or indications of an intention to withdraw or redeem, shall

be taken into account when they are actually funded out of the applicable account or, if

earlier and not revoked prior to the measurement date, the date the applicable notice of

withdrawal or redemption or indication of intention to withdraw or redeem is received,

and (iv) in the case of a Person that becomes a Client after the Base Date, or a Client that

establishes a new account after the Base Date, the adjustments described above shall be

reflected from and after the date such Person becomes a Client or such new account is

established, as applicable. Notwithstanding anything else in the Agreement to the

contrary, any calculation of Fixed Income Assets Under Management shall not include

any assets under management or assets under supervision for Free State of Saxony

(Germany).

“Fixed Income Business” means the portion of the Business that offers

U.S. fixed income, liquidity and municipal mutual funds and WRAPs, U.S. institutional

cash, short duration and municipal products, structured products, investment grade core

and index, high yield, loans, and other fixed-income asset management products and

services other than fixed income securities managed within, or on behalf of, the private

asset management business.

“Fixed Income Revenue Run-Rate” means, with respect to any Client as of

any date, the aggregate annualized Management Fees payable by such Client to the Fixed

Income Business, determined by multiplying, with respect to each account of such Client,

(a) the Fixed Income Assets Under Management for such Client as of the applicable date

with respect to such account by (b) the applicable annual fee rate (expressed as a

percentage) at which such Client pays Management Fees to the Fixed Income Business

with respect to such account as of the date of the most recent billed invoice; provided

,

however, that in the case of any account of such Client of which the investment adviser is

not wholly-owned by members of the Company Group that conduct the Fixed Income

Business, the Fixed Income Revenue Run-Rate shall be calculated by multiplying the

foregoing product by the aggregate percentage participation of the members of the

Company Group that conduct the Fixed Income Business in the revenues or income, as

applicable, of such investment adviser with respect to such account. For purposes of this

definition, the “applicable annual fee rate” for any Client account shall be adjusted if

applicable to take into account any fee waiver, cap, expense reimbursement or rebate

arrangements, or any agreements regarding reallowance of administration or sub- or co-

16

administration fees in effect as of such date in connection with such account that have not

already been taken into account in the calculation of Fixed Income Revenue Run-Rate.

The calculation of the Fixed Income Revenue Run-Rate of any Client shall in all cases be

determined using the same methodology used to determine the Fixed Income Revenue

Run-Rates reflected in the fixed income revenue run-rate Excel file previously provided

by Parent to Purchaser.

“Fixed Income Revenue Run-Rate Percentage” means, as of any given

date, the Aggregate Fixed Income Revenue Run-Rate, as of such date, divided by the

Base Aggregate Fixed Income Revenue Run-Rate, expressed as a percentage.

“Foreign Plan” has the meaning set forth in Section 4.14(h).

“Fund” means any partnership, limited liability company or other

investment vehicle to which any member of the Company Group, directly or indirectly,

provides investment advisory services or serves as the general partner, managing member

or in any similar capacity.

“Fund Amendments” has the meaning set forth in Section 7.4(b).

“Furniture and Equipment” means all furniture, fixtures, furnishings,

equipment, vehicles, leasehold improvements, and other tangible personal property

owned or used by Seller and its Subsidiaries (other than the Acquired Subsidiaries) in the

conduct of the Business, including all desks, chairs, tables, Hardware, copiers, telephone

lines and numbers, telecopy machines and other telecommunication equipment, cubicles

and miscellaneous office furnishings and supplies.

“GAAP” means U.S. generally accepted accounting principles as in effect

from time to time.

“Governmental Body

” means any government, court, regulatory,

investigative or administrative agency, commission or authority, or other governmental

instrumentality, arbitral body or Self-Regulatory Organization, federal, state or local,

domestic, foreign or multinational.

“Guarantees” has the meaning set forth in Section 6.7.

“Hardware” means any and all computer and computer-related hardware,

networks and peripherals, including but not limited to, information and communication

systems, computers, file servers, facsimile servers, scanners, color printers, laser printers

and networks.

“Hedge Fund Minority Stake Investments

” means Parent’s and its

Affiliates’ minority stake investments in the following asset management firms, including

Parent’s and its Affiliates’ investments on a principal basis in any such firms’ underlying

managed funds: D.E. Shaw & Co., Ospraie Management, Spinnaker Capital, R3 Capital

17

Partners, One William Street Capital, Field Street Capital Management, GLG Partners,

BlueBay Asset Management, Synergy and Integrated Asset Management.

“Holdback Amount” means (a) if the Audited Financial Statements have

been delivered to Purchaser prior to the Closing, an amount equal to $140,000,000 or (b)

if the Audited Financial Statements have not been delivered to Purchaser prior to the

Closing, an amount equal to $390,000,000.

“Holdback Release Amount” means (a) if Parent validly elected in

accordance with this Agreement to cause the Estimated Aggregate Additional Adjustment

to equal $850,000,000, the Holdback Amount or (b) if Parent did not validly elect in

accordance with this Agreement to cause the Estimated Aggregate Additional Adjustment

to equal $850,000,000, an amount equal to the Holdback Amount minus $140,000,000.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of

1976, as amended, and the rules and regulations promulgated thereunder.

“Interests” has the meaning set forth in Section 4.3.

“Intellectual Property Licenses” means (a) any grant to a third person of

any license, immunity, a covenant not to sue or otherwise any right to use or exploit, any

of the Purchased Intellectual Property owned by the Seller or any of its Subsidiaries,

controlled by Seller or any Subsidiary as a sublicensor, or the use or exploitation of

which is otherwise controlled by Seller or any Subsidiary; and (b) any grant to Seller or

any of its Subsidiaries of a license, immunity or covenant not to sue or otherwise any

right to exploit any Purchased Intellectual Property or other Intellectual Property Rights

by any third party.

“Intellectual Property Rights” means all of the rights arising from or in

respect of intellectual property rights, however denominated, throughout the world,

whether or not registered, including the following: (a) patents, patent applications, any

reissues, reexaminations, divisionals, continuations, continuations-in-part and extensions

thereof; (b) trademarks, service marks, trade names, service names, industrial designs or

similar design rights, product configuration, trade dress rights, Internet domain names,

identifying symbols, logos, emblems, slogans, signs, insignia, and other brand or source

identifiers, as well as all goodwill associated with the foregoing (collectively, “Marks

”);

(c) copyrights and other proprietary works of authorship, and registrations and

applications therefor; (d) trade secrets, proprietary data, and other proprietary or

protected information, including data or information that any Person is obligated to treat

as proprietary through Contract, binding policies of any trade or professional association,

or other private or consensual arrangement; (e) rights of privacy and publicity, and moral

rights; and (f) all applications, registrations, permits, claims and rights of action arising

from or relating to any of the foregoing.

“Investment Advisers Act

” means the Investment Advisers Act of 1940

and the rules and regulations promulgated thereunder, as amended from time to time.

18

“Investment Company Act” means the Investment Company Act of 1940

and the rules and regulations promulgated thereunder, as amended from time to time.

“Investment Company Financial Statements” has the meaning set forth in

Section 4.6(b)

.

“IRS

” means the United States Internal Revenue Service and, to the extent

relevant, the United States Department of Treasury.

“Key Person” means, with respect to a Team, each Person designated as a

“Key Person” on the Team Run Rate Schedule.

“Knowledge of the Company

” means the actual knowledge of those

Persons identified on Schedule 1.1(o)

.

“Landlord Consent” shall mean any consent or approval from any landlord

under an underlying Transferred Real Property Lease or Subleased Real Property Lease

which is required pursuant to the terms of such Transferred Real Property Lease or

Subleased Real Property Lease in order to effectuate the applicable assignment or

sublease and/or any waivers from any landlord to the extent that any landlord under an

underlying Transferred Real Property Lease or Subleased Real Property Lease has

recapture and/or termination rights that would be triggered by the proposed assignment or

sublease.

“Law” means any law or statute, code, ordinance, common-law doctrine,

rule or regulation having the force of law, issued by any Governmental Body.

“Legal Proceeding” means any judicial or administrative action, suit or

proceeding by or before a Governmental Body.

“Liability” means any debt, liability, commitment or obligation of any

kind, whether fixed, contingent or absolute, matured or unmatured, liquidated or

unliquidated, accrued or not accrued, asserted or not asserted, known or unknown,

determined, determinable or otherwise, whenever or however arising (including, whether

arising out of any Contract or tort based on negligence or strict liability).

“Lehman Brothers Pension Scheme (UK)” means the Lehman Brothers

Pension Scheme, which was established by a deed dated 15 June 1965.

“Lien

” means any mortgage, pledge, security interest, adverse claim, right

of first refusal, option, encumbrance, lien or charge of any kind (including any

conditional sale or other title retention agreement or lease in the nature thereof), any sale

of receivables with recourse against the Business or their respective assets, any filing or

agreement to file a financing statement as debtor under the uniform commercial code as

in effect in the State of New York or any similar statute (other than to reflect ownership

by a third party of property leased to the Business under a lease which is not in the nature

19

of a conditional sale or title retention agreement), or any subordination arrangement in

favor of another Person.

“Loss” or “Losses” has the meaning set forth in Section 9.2.

“Management Fees

” means any investment advisory, administration,

investment management, sponsor, subadvisory, supervisory, and similar management or

advisory fees (including custody and other fees for trust accounts), in each case that are

computed by reference to assets under management and are payable to any member of the

Company Group in respect of any Fund or Client account, which, for the avoidance of

doubt, excludes (a) Performance Fees, (b) transaction-based fees or referral fees and (c)

any extraordinary or non-recurring revenue items.

“Mark(s)

” has the meaning ascribed to it in the definition of Intellectual

Property Rights set forth above.

“Material Adverse Effect” means any change, event, occurrence or effect

that, individually or in the aggregate, has had or could reasonably be expected to have a

material adverse effect on the business, financial condition or results of operations of the

Business taken as a whole, other than any such change, event, occurrence or effect

resulting from (i) the announcement of the execution of this Agreement and of the

transactions contemplated hereby (including the impact on customers and employees),

(ii) changes after the Execution Date in the United States or world economy or in United

States or global financial market conditions (including changes in interest rates or prices

of securities generally), (iii) changes after the Execution Date in general political

conditions in the United States or worldwide, (iv) changes in legal or regulatory

conditions to the extent generally affecting the investment advisory and asset

management industry, (v) any failure to meet forecasts or projections, in and of itself (as

opposed to the facts and circumstances underlying any such failure, which will not be

excluded), (vi) the commencement of any Bankruptcy Case at the written request of the

Purchaser, (vii) any decrease in the S&P 500 Index and (viii) any matter for which an

adjustment to the Base Purchase Price would be made pursuant to this Agreement (to the

extent of such adjustment); provided

, however, that changes, events, occurrences and

effects resulting from items (ii), (iii) and (iv) will only be excluded if they do not have a

disproportionate effect on the Business relative to other businesses in the investment

advisory and asset management industries.

“Material Contracts

” has the meaning set forth in Section 4.13(a).

“Measurement Date

” means a day selected by the Purchaser as the

Measurement Date by notice to the Parent no later than the opening of trading on the

New York Stock Exchange on such day, which day may be the True-Up Date or a day

that is 15, 30, 45, 60, 75, 90, 105 or 120 days after the True-Up Date (or, if any such day

is not a Business Day, the first Business Day after such day); provided

, however, that if

the Purchaser does not make such a selection, then the Measurement Date shall be the

20

date that is 120 days after the True-Up Date (or, if such day is not a Business Day, the

first Business Day after such day).

“Measurement Date Aggregate NB Revenue Run-Rate” means the sum of

(a) the aggregate NB Revenue Run-Rate, calculated in each case as of the close of

business in New York on the Measurement Date, of all Consenting NB Clients of Teams

for which any Key Person or one or more Principal Persons was not Active as of either

the Closing Date or the True-Up Date, plus (b) the aggregate NB Revenue Run-Rate,

calculated as of the close of business in New York on the True Up Date, of (i) all

Consenting NB Clients of Teams for which all Key Persons and all Principal Persons

were Active on both the Closing Date and the True-Up Date and (ii) all Consenting NB

Clients that are not Clients of any Team; provided, however, that the aggregate NB

Revenue Run-Rate shall be $0 for all Consenting NB Clients of Non-Term Sheet Teams

for which any Key Person is, or both Principal Persons are, not Active at the Closing

Date and not Active at the Measurement Date.

“Measurement Date Holdback Amount” means an amount equal to the

Holdback Amount minus the Holdback Release Amount.

“Measurement Date NB Adjustment” means:

(a) if the Measurement Date NB Revenue Run-Rate Percentage equals

or exceeds 100%, then $0;

(b) if the Measurement Date NB Revenue Run-Rate Percentage is less

than 100%, but greater than or equal to 70%, a dollar amount equal to the product of (i)

0.5 multiplied by (ii) the difference between (A) the Total Base Aggregate NB Revenue

Run-Rate minus (B) the Measurement Date Aggregate NB Revenue Run-Rate multiplied

by (iii) 7.5; or

(c) if the Measurement Date NB Revenue Run-Rate Percentage is less

than 70%, a dollar amount equal to the product of (i) 0.5 multiplied by

(i) 30% of the

Total Base Aggregate NB Revenue Run-Rate multiplied by

(iii) 7.5.

“Measurement Date NB Revenue Run-Rate Percentage

” means the

Measurement Date Aggregate NB Revenue Run-Rate, divided by the Total Base

Aggregate NB Revenue Run-Rate, expressed as a percentage.

“Measurement Date Schedule” has the meaning set forth in Section

2.11(c).

“Measurement Date Schedule Calculation” has the meaning set forth in

Section 2.11(c)

.

“NB Adjusted Assets Under Management

” means, for any Client as of the

close of business in New York on a particular measurement date, the amount, expressed

21

in U.S. dollars, of assets under management or other assets with respect to model

portfolios by the NB Business for that Client as of the Base Date. In calculating NB

Adjusted Assets Under Management for a date that is after the Base Date, the calculation

shall be:

(a) adjusted to reflect the net cash flows (i.e., additions, including, in

the case of Funds, reinvestments of distributions or dividends, and redemptions and

withdrawals, including, in the case of Funds, dividends and distributions) after the Base

Date and on or prior to the measurement date with respect to the accounts of such Clients;

(b) reduced for accounts that, after the Base Date and on or prior to the

measurement date, are terminated or with respect to which notices of termination or

indications of an intent to terminate are received and not revoked;

(c) not adjusted for any increase or decrease in the amount of assets

under management for any Client due to market appreciation or depreciation or currency

fluctuations, in each case, from and after the Base Date; and

(d) not adjusted for any increase or, with respect to the assets

identified on Schedule 1.1(p), decrease after the Base Date in the amount of assets

invested in any Fund by Parent or any of its controlled Affiliates acting as principal on its

own behalf or in a fiduciary capacity on behalf of Clients where Parent or such controlled

Affiliate has investment discretion.

For purposes of this definition: (i) any assets under management for any

Client account for which the Seller or members of the Company Group act as investment

adviser and sub-adviser will be counted only once; (ii) any assets under management for

any set of Client accounts, one of which invests in the other will be counted only once if

members of the Company Group or the Seller act as investment advisor to both; (iii)

withdrawals and redemptions, or indications of an intention to withdraw or redeem, shall

be taken into account when they are actually funded out of the applicable account or, if

earlier and not revoked prior to the measurement date, the date the applicable notice of

withdrawal or redemption or indication of intention to withdraw or redeem is received;

provided

that transfers from one Fund associated with the Business to another Fund

associated with the Business will be considered to have taken place on the date such

transfer is credited to the transferee Fund; and (iv) in the case of a Person that becomes a

Client after the Base Date, or a Client that establishes a new account after the Base Date,

the adjustments described above shall be reflected from and after the date such Person

becomes a Client or such new account is established, as applicable.

“NB Business” means the portion of the Business that is the private asset

management business (including relevant fixed income securities managed within, or on

behalf of, the private asset management business), equities mutual fund, equities closed

end fund, equities sub-advised fund, equities WRAP (Managed Account Group and

model portfolio assets), equities global balanced portfolio, and the equities institutional

22

separate accounts businesses. The NB Business does not include the Fixed Income

Business.

“NB Business Financial Information” has the meaning set forth in

Section 4.6(a)

.

“NB Revenue Run-Rate

” means, with respect to any Client as of any date,

the aggregate annualized Management Fees payable by such Client to the NB Business,

determined by multiplying, with respect to each account of such Client, (a) the NB

Adjusted Assets Under Management for such Client as of the applicable date with respect

to such account by (b) the applicable annual fee rate (expressed as a percentage) at which

such Client pays Management Fees to the NB Business with respect to such account as of

the then most recent billed invoice; provided, however, that in the case of any Client

account of which the investment adviser is not wholly-owned by one or more members of

the Company Group that conduct the NB Business, NB Revenue Run-Rate shall be

calculated by multiplying the foregoing product by the aggregate percentage participation

of the members of the Company Group in the revenues or income, as applicable, of such

investment adviser with respect to such Client account. For purposes of this definition,

the “applicable annual fee rate” for any Client account shall be adjusted if applicable to

take into account any fee waiver, cap, expense reimbursement or rebate arrangements, or

any agreements regarding reallowance of administration or sub- or co-administration fees

in effect as of such date in connection with such Client account. As of any date after the

Base Date, NB Revenue Run-Rate of any Client will be reduced to give effect to any

known reduction in the Management Fees related to assets under management for which

the Trust Companies provide trust services (even if such reduction has yet to become

effective). The calculation of the NB Revenue Run-Rate of any Client shall in all cases be

determined using the same methodology used to determine the NB Revenue Run-Rates

reflected in the NB revenue run-rate Excel file previously provided to Purchaser.

“New Debtor

” has meaning set forth in Section 7.25(g).

“NBH Financials

” has the meaning set forth in Section 4.6(a).

“New Public Fund Investment Advisory Agreement

” has the meaning set

forth in Section 7.14(a).

“Non-exclusive Intellectual Property Rights” has the meaning set forth in

Section 2.6(e)

.

“Non-Term Sheet Team” means any Team that is not a Term Sheet Team.

“OCC

” has the meaning set forth in Section 2.4(q).

“Offeree

” has the meaning set forth in Section 7.9(a).

23

“Order” means any order, injunction, judgment, decree or ruling of a

Governmental Body.

“Original Purchase Agreement” has the meaning set forth in the recitals.

“Other Public Fund Agreements

” has the meaning set forth in

Section 7.14(a)

.

“Parent” has the meaning set forth in the preamble.

“PBGC” means the Pension Benefit Guaranty Corporation.

“Pensions Regulator” means the Pensions Regulator established under

section 1 of the UK Pensions Act.

“Performance Fees” means any carried-interest, incentive or other fees

based on investment-performance.

“Permits” means any approvals, authorizations, consents, licenses,

permits, registrations or certificates of a Governmental Body.

“Permitted Exceptions” means (i) statutory liens for Taxes, assessments or

other governmental charges not yet delinquent or the amount or validity of which is being

contested in good faith by appropriate proceedings and for which appropriate reserves

have been established in accordance with GAAP, (ii) mechanics’, carriers’, workers’,

repairers’, landlords’, warehouse and similar Liens arising or incurred in the ordinary

course of business not yet delinquent, (iii) zoning, entitlement and other land use and

environmental regulations by any Governmental Body, (iv) the title and rights of lessors,

lessees, licensors and licensees, as applicable, under leases and licenses executed in the

ordinary course of business, (v) all defects, exceptions, restrictions, easements, rights of

way and encumbrances disclosed in any policies of title insurance made available to the

Purchaser and (vi) other imperfections in title, charges, easements, restrictions and

encumbrances which do not impair in any material respect the existing use of the related

assets in the Business currently conducted.

“Person” means any individual, corporation, limited liability company,